itogi-2012.ru

Tools

How Much Interest Are You Paying On Your Mortgage

:max_bytes(150000):strip_icc()/dotdash-111214-buying-home-cash-vs-mortgage-v2-325bbfe3ca7343ca904ecaa9d2cb6c67.jpg)

P = the principal amount; i = monthly interest rate. Typically, lenders like to present interest rates on an annual basis, so you'll need to divide the. Mortgage payment calculator. See how much you can expect to pay each month based on the rate, term and other factors. If you buy a home with a loan for $, at percent your monthly payment on a year loan would be $, and you would pay $, in interest. Making extra payments every month can reduce the total amount of interest paid and help you pay off your loan faster. Add Extra Monthly Payment Amount. Total. For example, if you borrow $, at a 4% interest rate, your very first monthly payment will include $ in interest and $ toward the principle. A mortgage payment calculator takes into account factors including home price, down payment, loan term and loan interest rate in order to determine how much you. Your daily interest is $ This is calculated by first multiplying the $, loan by the % interest rate, then dividing by If the mortgage closes. Any interest paid on first or second mortgages over this amount is not tax deductible. Home equity loans are limited to $, or the amount of equity you. The way that the interest portion of your payment is calculated is by multiplying the remaining principle by the interest rate, and dividing by. P = the principal amount; i = monthly interest rate. Typically, lenders like to present interest rates on an annual basis, so you'll need to divide the. Mortgage payment calculator. See how much you can expect to pay each month based on the rate, term and other factors. If you buy a home with a loan for $, at percent your monthly payment on a year loan would be $, and you would pay $, in interest. Making extra payments every month can reduce the total amount of interest paid and help you pay off your loan faster. Add Extra Monthly Payment Amount. Total. For example, if you borrow $, at a 4% interest rate, your very first monthly payment will include $ in interest and $ toward the principle. A mortgage payment calculator takes into account factors including home price, down payment, loan term and loan interest rate in order to determine how much you. Your daily interest is $ This is calculated by first multiplying the $, loan by the % interest rate, then dividing by If the mortgage closes. Any interest paid on first or second mortgages over this amount is not tax deductible. Home equity loans are limited to $, or the amount of equity you. The way that the interest portion of your payment is calculated is by multiplying the remaining principle by the interest rate, and dividing by.

Each month, you are charged 1/12 of the interest rate based on your remaining principal balance that month. So let's take your example of a $ Use this simple amortization calculator to see a monthly or yearly schedule of mortgage payments. Compare how much you'll pay in principal and interest and. But you will pay more interest overall with a year loan. 30 Year Fixed, 15 Year Fixed. Include Tax, Insurance and Fee in your monthly payment. Property Tax. An online mortgage calculator can help you quickly and accurately predict your monthly mortgage payment with just a few pieces of information. With this 'how much interest will I pay' calculator, you'll quickly determine how much interest you'll pay on your mortgage, car loans, & much more. This tool allows you to calculate your monthly home loan payments, using various loan terms, interest rates, and loan amounts. Let's say you have a year fixed-rate mortgage for $,, with an interest rate of 4%. If you make your regular payments, your monthly mortgage principal. SmartAsset's mortgage payment calculator considers four factors - your home price, down payment, mortgage interest rate and loan type - to estimate how much you. How much of a down payment do you need? To get the best mortgage interest rates and terms, you'll want a down. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. 1. Bi-weekly mortgage payments · 2. Extra mortgage payments · 3. Drop Private Mortgage Insurance (PMI) · 4. Recast your mortgage · 5. Streamline refinance. When you have a mortgage on your home, the interest rate is the ongoing amount you pay to finance your home purchase. Your interest rate is typically. Using Bankrate's mortgage calculator, we found that someone purchasing a median-priced home with a typical 20% down payment would owe $, in interest. Use this mortgage calculator to determine your monthly payment and generate an estimated amortization schedule. Quickly see how much interest you could pay. Mortgage interest rates are normally expressed in Annual Percentage Rate (APR), sometimes called nominal APR or effective APR. It is the interest rate expressed. This chart covers interest rates from 1% to %, and loan terms of 15 and 30 years. Each of the term columns shows the monthly payment (Principal + Interest). You can take the loan term in years and multiply it by 12 to get this number. For example, there are monthly payments on a year mortgage. How Much House. Mortgage interest is the cost you pay your lender each year to borrow their Adjust your down payment size to see how much it affects your monthly payment. So if you lower your principal, you'll lower your remaining interest as well. With some mortgages, though, your lender will assess a prepayment penalty if you. The standard mortgage in the US accrues interest monthly, meaning that the amount due the lender is calculated a month at a time. There are some mortgages.

Lowest Car Insurance Rates In Georgia

The annual average cost of full coverage car insurance in Georgia is $2, and $ for minimum coverage — slightly higher than the national average of $2, How much does an auto insurance policy cost in Georgia? According to Bankrate the average annual cost for minimum coverage in Georgia is $ For full. Auto-Owners Insurance has the cheapest car insurance rates in Georgia, on average. Its average annual rate of $1, is $ per year less expensive than the. Lowest Rates Guaranteed: We specialize in finding you the most affordable auto insurance rates in Georgia. Our goal is to save you money without compromising on. Auto-Owners Insurance has the cheapest car insurance rates in Georgia, on average. Its average annual rate of $1, is $ per year less expensive than the. What Is the Average Premium for Cheap Full Coverage Car Insurance in GA? Georgia drivers pay an average of $ monthly for full coverage. Full coverage. Cheapest Car Insurance in Georgia ; 1, Country Financial, $79 per month ; 2, Auto-Owners, $84 per month ; 3, Georgia Farm Bureau, $ per month ; 4, State Farm. We help you compare, find and buy the right car insurance policy at the lowest possible price for you. Start your quote from anywhere online or over the phone. Compare the cheapest car insurance quotes in Georgia from Auto-Owners, State Farm, COUNTRY Financial and more. Quotes updated August The annual average cost of full coverage car insurance in Georgia is $2, and $ for minimum coverage — slightly higher than the national average of $2, How much does an auto insurance policy cost in Georgia? According to Bankrate the average annual cost for minimum coverage in Georgia is $ For full. Auto-Owners Insurance has the cheapest car insurance rates in Georgia, on average. Its average annual rate of $1, is $ per year less expensive than the. Lowest Rates Guaranteed: We specialize in finding you the most affordable auto insurance rates in Georgia. Our goal is to save you money without compromising on. Auto-Owners Insurance has the cheapest car insurance rates in Georgia, on average. Its average annual rate of $1, is $ per year less expensive than the. What Is the Average Premium for Cheap Full Coverage Car Insurance in GA? Georgia drivers pay an average of $ monthly for full coverage. Full coverage. Cheapest Car Insurance in Georgia ; 1, Country Financial, $79 per month ; 2, Auto-Owners, $84 per month ; 3, Georgia Farm Bureau, $ per month ; 4, State Farm. We help you compare, find and buy the right car insurance policy at the lowest possible price for you. Start your quote from anywhere online or over the phone. Compare the cheapest car insurance quotes in Georgia from Auto-Owners, State Farm, COUNTRY Financial and more. Quotes updated August

K subscribers in the Georgia community. A subreddit for news and discussion about the state of Georgia in the Southeastern United States. Cheap Minimum Liability Car Insurance in Georgia · Travelers: $78 per month · Arrowhead: $85 per month · Amigo MGA: $71 per month · GEICO: $63 per month · The. Liability Insurance · Bodily Injury Liability – $25, per person and $50, per incident · Property Damage Liability – $25, per incident. Bankrate's analysis found that Mercury, Auto-Owners and Allstate offer some of the lowest rates for car insurance in Georgia. Mercury provides cheap car insurance in Georgia without sacrificing quality. Learn more about what coverage you need and why you should switch to Mercury. Car insurance in Georgia costs $ for a 6-month policy — 18% more expensive than than the national average rate. Data from ValuePenguin indicate that drivers pay the lowest rates for full coverage with Georgia Farm Bureau, with an average annual premium cost of $ We used our in-house reporting to determine the companies that offer the cheapest car insurance rates in Georgia. National General Value came in with the lowest. Compare the cheapest car insurance quotes in Atlanta from Hugo, Auto-Owners, State Farm, and more. Quotes updated August Freedom National offers fiercely competitive, rock bottom rates - many drivers find we offer the cheapest car insurance in Georgia! Country Financial is the cheapest car insurance company in Georgia overall, with an average rate of $45 per month for minimum coverage and $ per month for. Mercury provides cheap auto insurance without compromising on quality. Learn more about our cheap auto insurance policies in Georgia. Call , request a quote online or visit Direct Auto location near you to get a Georgia car insurance quote from Direct Auto! We always offer. The average car coverage cost in Georgia is $1, per year, which is lower than the national average cost. What Affects Car Insurance Rates in Georgia? Several. Affordable Auto Insurance Southern Atlanta · Contact. Phone: Fax: · Address. Pryor Rd. Ste. 2C Atlanta, GA · Hours. Mon - Fri. Based on our experience working with thousands of insurance policyholders in Georgia, we found that the average monthly cost of minimum liability coverage is. How much is car insurance in Georgia? Georgia drivers pay an average rate of $ annually for state-mandated minimum coverage. Full coverage, which. Auto-Owners insurance company has the cheapest car insurance in GA, according to The Zebra. The average annual rates are $, which is hundreds less than most. Find the Cheapest Car Insurance in Georgia & Compare Cheap Car Insurance Quotes from Top Georgia Car Insurance Companies Competing for your Business! We found that Country Financial offers the cheapest annual rate at $ in Georgia. The most expensive annual auto insurance rates are for Progressive which is.

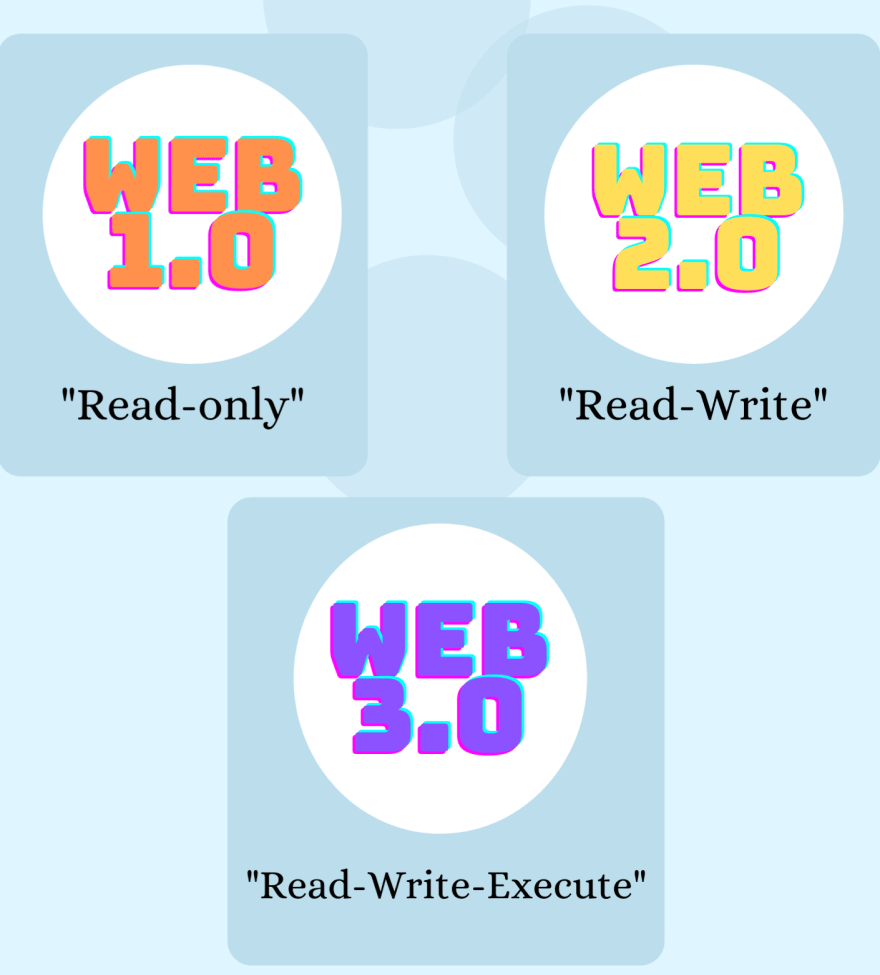

Definition Of Web 3.0

Web , also called the Semantic Web or Decentralized Web, is essentially the generation of the World Wide Web. What is web (web3)?. Web signifies the forthcoming stage in the evolution of the World Wide Web, serving as the user interface for. Web3 (also known as Web ) is an idea for a new iteration of the World Wide Web which incorporates concepts such as decentralization, blockchain technologies. Web (a.k.a. Internet or Web3) is the term used to describe the third iteration of the Internet. The Web3 concept postulates that the next version of. The web definition is a decentralised version of the internet that is not controlled or monitored by big corporations or the government like the. Web focuses on enhancing the intelligence and interoperability of the internet, leveraging AI, IoT, and semantic web technologies to create more. Web is defined as the creation of high-quality content and services produced by gifted individuals using Web technology as an enabling platform. Web. Web emphasizes the use of decentralized systems to allow users to own and manage their own data with more transparency than Web Controlled by. Web is the new innovative and revolutionary technological tool that analyses, integrates, and links data, which will help individuals, as well as. Web , also called the Semantic Web or Decentralized Web, is essentially the generation of the World Wide Web. What is web (web3)?. Web signifies the forthcoming stage in the evolution of the World Wide Web, serving as the user interface for. Web3 (also known as Web ) is an idea for a new iteration of the World Wide Web which incorporates concepts such as decentralization, blockchain technologies. Web (a.k.a. Internet or Web3) is the term used to describe the third iteration of the Internet. The Web3 concept postulates that the next version of. The web definition is a decentralised version of the internet that is not controlled or monitored by big corporations or the government like the. Web focuses on enhancing the intelligence and interoperability of the internet, leveraging AI, IoT, and semantic web technologies to create more. Web is defined as the creation of high-quality content and services produced by gifted individuals using Web technology as an enabling platform. Web. Web emphasizes the use of decentralized systems to allow users to own and manage their own data with more transparency than Web Controlled by. Web is the new innovative and revolutionary technological tool that analyses, integrates, and links data, which will help individuals, as well as.

Web will be more connected, open, and intelligent, with semantic Web technologies, distributed databases, natural language processing, machine learning. Web 3 is the user interface that gives Internet users access to many things. It can be documents, programs, and multimedia. Alright, Web3 in simple terms – it's the internet, but decentralized. No big boss calling the shots; it's a community affair. It's like a digital potluck where. Web is that the third generation of Internet services which will specialize in understanding and analyzing data to supply a semantic web. Web , or web3, is the third generation of the world wide web. The core principle of web is openness and decentralization. To achieve this, web relies. Key Factors of Web · Decentralization. Data is controlled by the user rather than stored in servers or large databases that HTTP provided to Web and Web. What Is Web ? Web3 refers to the use of blockchain technology to decentralize and improve the current internet infrastructure. It envisions a more open and. Instead of a web application or platform controlled by a centralized server or a centralized web system, Web is an open platform that allows ownership to be. Web3 is an umbrella term for technologies like blockchain that decentralize data ownership and control on the internet. The World Wide Web is the inaugural and foundational layer for internet use, providing website and application services. Web represents the third. The Semantic Web, sometimes known as Web is an extension of the World Wide Web through standards set by the World Wide Web Consortium (W3C). What is web (web3)?. Web signifies the forthcoming stage in the evolution of the World Wide Web, serving as the user interface for. Web 3 (also known as Web ) is considered the 3rd generation of the Internet. This is seen as a major shift in the identity layer of the Internet and, in many. Web (also known as Web3) can be described as an evolved version of the World Wide Web that leverages machine learning, artificial intelligence (AI). Web (also known as Web3) can be described as an evolved version of the World Wide Web that leverages machine learning, artificial intelligence (AI). Web describes the next evolution of the World Wide Web, the user interface that provides access to documents, applications and. Web is an AI/machine learning-driven web that will give you helpful search results based on the context of their queries rather than just the keywords. Web can be defined as a new era of the world wide web, using blockchain technology and incorporating concepts such as a permissionless entity. It will be a. Web is that the third generation of Internet services which will specialize in understanding and analyzing data to supply a semantic web.

How To Use Amazon Points

Browse American Express Customer Service to Learn How to Use Membership Rewards® Points on Amazon Purchases. Find Out How to Link Your Account. Online shopping for Shop with Points from a great selection at Credit Cards Store Conditions of Use · Privacy Notice · Interest-Based Ads. © , Amazon. Simply choose to apply points at checkout, and you can even set points to apply to all purchases automatically. Top of page. Your Orders · Your Lists. Can I use my Chase Amazon reward points to purchase a Prime Video? · Amazon Kindle eBooks. You may use Shop with Points to purchase a Kindle Unlimited. Present eGift card on mobile device at the time of payment, or print the eGift card page and present it at the time of payment. For online purchases, you'll. Use ThankYou® Points to shop itogi-2012.ru You can even use points to pay for recurring purchases and subscriptions, like Amazon Prime Video! step 1 img alt text. You can use your points for all or part of a payment for the purchase of eligible items at itogi-2012.ru If you don't have enough points to pay for a purchase at. With Amazon Shop with Points, you can redeem Capital One rewards on millions of itogi-2012.ru products. Your points can also be redeemed at Chase for cash back in any amount, gift cards in increments of $25/2, points, or for travel with no blackout dates or. Browse American Express Customer Service to Learn How to Use Membership Rewards® Points on Amazon Purchases. Find Out How to Link Your Account. Online shopping for Shop with Points from a great selection at Credit Cards Store Conditions of Use · Privacy Notice · Interest-Based Ads. © , Amazon. Simply choose to apply points at checkout, and you can even set points to apply to all purchases automatically. Top of page. Your Orders · Your Lists. Can I use my Chase Amazon reward points to purchase a Prime Video? · Amazon Kindle eBooks. You may use Shop with Points to purchase a Kindle Unlimited. Present eGift card on mobile device at the time of payment, or print the eGift card page and present it at the time of payment. For online purchases, you'll. Use ThankYou® Points to shop itogi-2012.ru You can even use points to pay for recurring purchases and subscriptions, like Amazon Prime Video! step 1 img alt text. You can use your points for all or part of a payment for the purchase of eligible items at itogi-2012.ru If you don't have enough points to pay for a purchase at. With Amazon Shop with Points, you can redeem Capital One rewards on millions of itogi-2012.ru products. Your points can also be redeemed at Chase for cash back in any amount, gift cards in increments of $25/2, points, or for travel with no blackout dates or.

Using Amazon Points · After selecting Proceed to Checkout, select the check box in the Amazon Points section on the Payment Options page. · Confirm that your. Once you complete the enrollment process, you can redeem your available Bilt Points to pay for purchases at itogi-2012.ru How do I enroll my Bilt Rewards account. Amazon Pay automatically alerts you when your credit card has points available, and you can use them to shop beyond itogi-2012.ru Just look for the Amazon Pay. Take advantage of this shortcut to simplified online shopping. Check out without entering your Card details. Earn rewards your Card is eligible for whenever. You can use your points for eligible purchases at itogi-2012.ru or redeem your points through itogi-2012.ru for cash back, gift cards, and travel. Minimum redemption. Go to your Account, scroll all the way to the bottom to where it says "Shopping programs and rental". Select Shop with Points and re-enroll your card in the. Can I apply rewards points to my order when using Shared Pay settings for my Amazon Business Account? Shop with Points is a seamless part of the itogi-2012.ru shopping experience you know and love. Simply choose to apply points at checkout, and you can even set. Use ThankYou® Points to shop itogi-2012.ru You can even use points to pay for recurring purchases and subscriptions, like Amazon Prime Video! step 1 img alt text. How to Shop with Points at itogi-2012.ru · 1. Enroll your card · 2. Shop · 3. Proceed to checkout · 4. Place your order. Just look for the Amazon Pay button at checkout and select your Amazon Store Card rewards points as your payment method to pay for your purchase. itogi-2012.ru To use Hilton Honors Points to pay for part or all of your purchase, you must first link your Hilton Honors account to your itogi-2012.ru account. Once you are. Ways to redeem include everyday purchases with Amazon, Starbucks and Gift Cards, cash credits that can be applied to pay down your TD Credit Card and travel. $50Amazon Gift Card ; 3%back at itogi-2012.ru and on. Chase Travel purchases ; 2%back at gas stations, restaurants, and on local transit. Can I apply rewards points to my order when using Shared Pay settings for my Amazon Business Account? Redeem a Gift Card · Find the claim code. · Go to Redeem a Gift Card. · Enter your claim code and select Apply to Your Balance. Amazon Store Card · Rewards. None · Welcome bonus. $80 itogi-2012.ru gift card upon approval · Annual fee. $0 · Intro APR. Pay no interest on all Amazon purchases of. › “card account” means your Amazon Visa or Prime Visa credit card account, or any account number used by you or an authorized user to access your card account. Amazon Points can be used to pay for purchases made on the itogi-2012.ru website. Each Amazon Point is worth ¥1 when used to buy any item. It's really easy. Link your Membership Rewards account to your itogi-2012.ru account, choose your linked American Express Card as your payment method and Amazon.

Best Generator Warranty

All DuroMax/DuroStar Power Equipment warrant the original purchasers to a 3-year Parts Warranty (Residential Use ONLY: Unusually heavy or commercial use is. Industry Leading Home Generator Warranty Cummins offers a competitive base warranty with fewer exclusions than other brands for your home generator. Cost-. Get free shipping on qualified 3 Year Warranty Portable Generators products or Buy Online Pick Up in Store today in the Outdoors Department. Westinghouse | WGen portable generator in box accessories: Manual, warranty, quick start guide. Westinghouse |. Some things to consider when purchasing a generator include the size or power output of the machine, ease of use, and other quality features. Warranty · Generator Manuals · Service Centers · Find an Installer · Home DuroMax Power Equipment is the pioneer in multifuel portable generator technology. The warranty policy is the longest in the industry — valued at $1, — and offers customers peace of mind through timely repair or replacement of parts on the. Generator extended warranties often offer coverage for one to five years. Consider how frequently you use your generator and the expected lifespan of the. Liberty Home Guard's generator warranty ensures reliable power backup, offering cost-saving, extensive coverage for major brands. All DuroMax/DuroStar Power Equipment warrant the original purchasers to a 3-year Parts Warranty (Residential Use ONLY: Unusually heavy or commercial use is. Industry Leading Home Generator Warranty Cummins offers a competitive base warranty with fewer exclusions than other brands for your home generator. Cost-. Get free shipping on qualified 3 Year Warranty Portable Generators products or Buy Online Pick Up in Store today in the Outdoors Department. Westinghouse | WGen portable generator in box accessories: Manual, warranty, quick start guide. Westinghouse |. Some things to consider when purchasing a generator include the size or power output of the machine, ease of use, and other quality features. Warranty · Generator Manuals · Service Centers · Find an Installer · Home DuroMax Power Equipment is the pioneer in multifuel portable generator technology. The warranty policy is the longest in the industry — valued at $1, — and offers customers peace of mind through timely repair or replacement of parts on the. Generator extended warranties often offer coverage for one to five years. Consider how frequently you use your generator and the expected lifespan of the. Liberty Home Guard's generator warranty ensures reliable power backup, offering cost-saving, extensive coverage for major brands.

Generac is a good and reliable brand. I have a 24kw Generac standby generator at my house. Anything can break though. Your warranty is provided by the original generator manufacturer and/or by the engine manufacturer that is coupled to the generator. Extended warranties are available for purchase on ABLE water cooled diesel generators. The standard Water Cooled Diesel Generator warranty is as follows. At Generator Systems LLC, we understand the importance of keeping your standby generator in top condition. Our experienced technicians are equipped with the. This extended service Generator warranty will help to cover the cost of repairs and/or replacements should something go wrong. GSM Services are licensed & insured home generator installers. Great prices & warranty on generators. Certified Generac generator installer ✓ Best Warranty &. Unauthorized installers can void your warranty. Even the best electricians in the trade have unintentionally damaged controls. If this occurs then repairs are. Generac also offers extended year warranties for home standby generators through various programs and campaigns. These are obtained through Generac's. Power Solutions Specialist Services. Industry best generator repair services & warranty options. Over time, your generator will likely need some repairs. Generac's XTEFI portable generator boasts electric start capabilities, consistently smooth power and enhanced protection from the elements to ensure. Electric Generators Direct offers two main warranty types: a standard warranty, and an extended protection plan. Generac 10 Year Extended Warranty on kW Generators · Years Covers Parts, Labor and Limited Travel · Generator must be registered and proof of purchase. 5-year Extended Warranty: If anything happens to your generator for any reason in the next 5 years, we'll replace it for FREE (we'll even cover shipping). SERIES Hybrid ; TYPE Open Frame Generator ; Industry-Leading Warranty. New FIRMAN generators are backed by a 3-year warranty. Refurbished generators have a. ARK Generator Services has many different warranties for different products and services. We have some of the best warranties in the business. A seven year. Trinity Warranty Extended Service Agreements for generators Our residential and commercial Standby Generator Programs were designed specifically to help you. Warranty. Yamaha Power Product Warranty. What products are covered by this warranty? Yamaha portable generators and multi purpose engines. Warranty periods. And because this is a WEN Product, your inverter generator comes backed by a 2-year warranty, a nationwide network of skilled service technicians and a friendly. Best Overall: Briggs and Stratton PowerProtect 26kW Home Standby Generator ; Best Budget: Wen GNX Generator ; Best for Standby Power: Generac Guardian 24kW. At Specialized Power Services Inc, we understand the importance of keeping your Generac automatic home backup generator in top condition. Serving the Southeast.

Best Whole Life Insurance For Over 50

Whole life insurance can be a good option for seniors because the guaranteed death benefit ensures that your loved ones will receive a generally tax-free gift. An over 50s life insurance plan pays out a fixed lump sum to your loved ones when you die. It'll give you peace of mind that they'll have the money available. At age 50 or older, term life will generally be the most affordable option for getting the death benefit needed to help ensure your family is provided for. 2. SunLife is the dominant market leader of these plans, and far from the best – both in cost and in favourable terms. All of the main policies require you to pay. Best fit if seeking. Lifetime coverage to help pay final expenses. Eligibility, ages 50– Premiums. Guaranteed to stay the same for your entire life. Term Life Insurance is a policy that provides coverage over a specified period of time, as outlined in the policy language. This option offers traditional life. We offer Guaranteed acceptance whole life insurance for those ages (in most states) with options starting at $ a month. RAPIDecision Final Expense is available to people who are between the ages of 50 and Does whole life insurance cost more than term life? In general, yes. Protective is our pick for best term insurance company for overs because term policies are very affordable and issue ages are high. We collected quotes for. Whole life insurance can be a good option for seniors because the guaranteed death benefit ensures that your loved ones will receive a generally tax-free gift. An over 50s life insurance plan pays out a fixed lump sum to your loved ones when you die. It'll give you peace of mind that they'll have the money available. At age 50 or older, term life will generally be the most affordable option for getting the death benefit needed to help ensure your family is provided for. 2. SunLife is the dominant market leader of these plans, and far from the best – both in cost and in favourable terms. All of the main policies require you to pay. Best fit if seeking. Lifetime coverage to help pay final expenses. Eligibility, ages 50– Premiums. Guaranteed to stay the same for your entire life. Term Life Insurance is a policy that provides coverage over a specified period of time, as outlined in the policy language. This option offers traditional life. We offer Guaranteed acceptance whole life insurance for those ages (in most states) with options starting at $ a month. RAPIDecision Final Expense is available to people who are between the ages of 50 and Does whole life insurance cost more than term life? In general, yes. Protective is our pick for best term insurance company for overs because term policies are very affordable and issue ages are high. We collected quotes for.

AARP/New York Life: · Prudential: · Nationwide: ; Term Life Insurance: · Whole Life Insurance: Whole life insurance offers · Final Expense Insurance: ; Financial. DreamSecure Senior Whole Life Insurance for applicants ages 50 to 80 covers your lifetime. The coverage options are $10, and $15, Compare Whole Life Insurance Quotes Over 50 GUL policies offer the most affordable rates for year-olds looking for permanent coverage. They do not require. Your financial strength, powered by ours. For over years, we've been committed to helping our clients succeed. And we're good at it. Guide to affordable life insurance for those 50+. We explore pricing options, joint life insurance, no medical exam policy, and your questions. Instant term life insurance through SelectQuote offers up to $5 million in coverage for those in good health and age 60 years or younger. The approval process. The premium, however, can never be more than the maximum guaranteed premiums stated in the policy. Permanent Insurance (Whole Life or Ordinary Life). While term. Healthy men over 70 can expect to pay $ to $ for a ten-year term life insurance policy with a $, death benefit. And healthy women will pay between. term coverage after separation from service. Learn more about the difference between term and whole life coverage. VGLI Servicemembers with full-time SGLI. Due to their policy length, whole life premiums may cost more than term life insurance premiums Select the payment option that works best for you. For several compelling reasons, New York Life is the best life insurance company for people over Unlike some insurers, the company offers both term and. Term life insurance is a great option for seniors if you have an idea of how long you may desire to have coverage for because you can choose the specific length. According to US News & World Report, if you are in the market for new coverage, Prudential, Lincoln Financial, and Banner Life are some of the best-term. Americo Insurance logo AM Best: A, From: To: 85, $5, - $30, ; Transamerica AM Best: A, From: To: 80, $25, - $2,, ; Sons of Norway logo AM. Over 50s life insurance is a type of life insurance you can take out between the ages of 50 and 80 to financially protect your loved ones if you die. As long as. Whole life insurance is typically a good fit for you if you're looking for lifelong coverage and want to build cash value over time. Benefits whole life. Whole life insurance can help protect your spouse during retirement or become a legacy for your loved ones or a favorite charity. It also provides guaranteed. Lots of companies will offer seniors term life insurance, which is cheaper than final expense insurance. But, most seniors over 50 will only qualify for 10 or. If you are over the age of 50, getting life insurance is still possible. As you age, premiums for new policies may be higher and your options may be more. Whether it's whole life or term life, getting life insurance coverage is What is the best life insurance for people over 50 years old? Disclaimer.

0 On Transfers Credit Card

0% Intro APR for 21 months on balance transfers from date of first transfer; after that, the variable APR will be % - % based on your creditworthiness. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After. The best balance transfer credit cards charge no annual fee and offer 15 months or more of 0% APR for balance transfers. The balance transfer rate is the limited-time interest rate applied to the existing credit card balance you move over to the new card. It's common to see 0%. With no fee to transfer your balance and 0% interest on balance transfers for 12 months, our card is ideal for those wanting to keep costs low. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After. Get 0% Intro APR for 15 months on purchases and balance transfers; then % to % Standard Variable Purchase APR applies. After the transfer, for example, you still have to make the minimum monthly payment on the card before the due date to keep that 0% rate. And pay attention to. APR. 0% intro APR for 15 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+). 0% Intro APR for 21 months on balance transfers from date of first transfer; after that, the variable APR will be % - % based on your creditworthiness. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After. The best balance transfer credit cards charge no annual fee and offer 15 months or more of 0% APR for balance transfers. The balance transfer rate is the limited-time interest rate applied to the existing credit card balance you move over to the new card. It's common to see 0%. With no fee to transfer your balance and 0% interest on balance transfers for 12 months, our card is ideal for those wanting to keep costs low. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After. Get 0% Intro APR for 15 months on purchases and balance transfers; then % to % Standard Variable Purchase APR applies. After the transfer, for example, you still have to make the minimum monthly payment on the card before the due date to keep that 0% rate. And pay attention to. APR. 0% intro APR for 15 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+).

itogi-2012.ru, itogi-2012.ru and itogi-2012.ru are good places to look for 0% balance transfer deals. In addition to comparing number of months. 10 partner offers ; Citi Diamond Preferred Card · 0% for 21 months on Balance Transfers and 12 months on Purchases · % - % (Variable) ; Blue Cash Everyday. This is done by moving a credit card balance from one card to a new card that typically has a 0% interest rate for a specific amount of time. By utilizing an. 0% introductory interest rate on Balance Transfers for the first 10 months (% after that; annual fee $29). · Save up to hundreds of dollars a year on. 0% Intro APR on balance transfers for 15 months from date of first transfer and on purchases from date of account opening. After that, the variable APR will be. For most cards, the 0% period is only reserved for balance transfers that are made within the first 60 or 90 days – though always check your card for its time. 0% intro APR for 12 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. Get 0% intro APR on card balances you transfer during the first 18 months, with a 3 percent fee on each transfer, or $5, whichever is greater. · Or get 0% intro. Many credit cards offer promotional 0% rates on balance transfers. Promotional periods vary from 6 to 21 months, depending on the offer. Reflect® Card. Enjoy our lowest intro APR for 21 months. APR. 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. A 0% introductory APR offer on a credit card can save money by having all your payments go toward knocking out the principal balance instead of being used to. Banks offer 0% APR on purchases because they make money on interchange fees. And because they hope you will do exactly what you have done, and. Credit card balance transfer offers are hard to find and qualify for due to coronavirus. Here are some available 0% APR offers and alternatives for getting out. Yes, a 0% interest balance card may benefit you for a short time, but that 0% APR does not last forever. When the 0% introductory rate period is over, and it. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After. Easily compare and apply online for the best Balance Transfers credit cards with Visa. Find Visa credit cards with low interest rates, rewards and other. 0% intro APR for 18 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+) and. Our best balance transfer credit card with 0% intro APR for 21 Months. The Wells Fargo Reflect Visa is a no annual fee credit card for purchases and. By saving money on interest with 0% intro APR, you're able to pay off your credit card debt faster. Ideally, you'll be able to pay off your debt within the 0%.

Living In Canada Working In Usa

Canada defines itself largely in opposition to the United States and Britain. Quebec forms a distinct society, but links itself strongly to the US economy. Canada-U.S. cross-border financial planning. This forces many Canadian expats to work with multiple Canadian and U.S. practitioners which can be inefficient. You have to have a job offer, exit US, apply visa application, schedule for visa stamping in US embassy, go for visa interview and get the. Third Country Nationals (TCNs) who wish to apply for a US nonimmigrant visa in Canada or Mexico must make an appointment for an interview at a US Consulate. Immigration status: You would need a valid work permit or visa to work in Canada, even if remote. Your US work visa alone may not cover working. This is extremely important for Canada Permanent Residents who work in the United States by making day trips. For example, individuals living in Canada border. If you're a US citizen who wants to work in Canada, you'll need to apply for a work permit. There are a few different types of work permits available, including. No work credits are required. A supplementary benefit called Guaranteed Income. Supplement (GIS) is paid to OAS beneficiaries living in Canada who have. In order for a Canadian citizen or permanent resident to work in the USA, you must first have a job offer from a USA employer. There are several categories of. Canada defines itself largely in opposition to the United States and Britain. Quebec forms a distinct society, but links itself strongly to the US economy. Canada-U.S. cross-border financial planning. This forces many Canadian expats to work with multiple Canadian and U.S. practitioners which can be inefficient. You have to have a job offer, exit US, apply visa application, schedule for visa stamping in US embassy, go for visa interview and get the. Third Country Nationals (TCNs) who wish to apply for a US nonimmigrant visa in Canada or Mexico must make an appointment for an interview at a US Consulate. Immigration status: You would need a valid work permit or visa to work in Canada, even if remote. Your US work visa alone may not cover working. This is extremely important for Canada Permanent Residents who work in the United States by making day trips. For example, individuals living in Canada border. If you're a US citizen who wants to work in Canada, you'll need to apply for a work permit. There are a few different types of work permits available, including. No work credits are required. A supplementary benefit called Guaranteed Income. Supplement (GIS) is paid to OAS beneficiaries living in Canada who have. In order for a Canadian citizen or permanent resident to work in the USA, you must first have a job offer from a USA employer. There are several categories of.

Canadian citizens are allowed to work in the United States just like any other foreign national. However, before they can legally work in the United States or. Canadian citizens and permanent residents of Canada don't require a work permit or visa to work in Canada, regardless of their country of residence. Last year, I moved to Canada from India as a permanent resident. Having previously lived in both England and the United States, I figured life in Canada would. Most international students in the United States hold an F1 visa, which is the U.S. non-immigrant student visa. F1 students are allowed to work in the United. A visitor who intends to live, work, or study in the U.S. and who does not Members of Canada's First Nations and Native Americans born in Canada may travel. If you're a Canadian citizen or permanent resident with a US work visa you can live in Canada and work in the US. If you are a citizen of Canada. Many US Citizens Live In Canada And File Their Canadian Income Tax Returns, Unaware That They Also Have To File Annual US Tax Returns By June 15th. No work credits are required. A supplementary benefit called Guaranteed Income. Supplement (GIS) is paid to OAS beneficiaries living in Canada who have. U.S. citizens and residents who work in Canada and are exempt by Treaty from Canadian taxation may apply for exemption from withholding of income and other. How To Keep Your PR Status When You Have To Leave Canada? Permanent residents of Canada sometime need to reside abroad due work obligations, family matters. Could You Lose Access to Your American Investment Accounts? Optimizing Your Retirement Investments at Any Age; Working with a Cross-Border Advisor and. There are unique benefits to living both above and below the 49th parallel. Learn about some of the differences for U.S. and Canadian citizens. Over one million US citizens live in Canada. Canada's peaceful, liberal culture, coupled with the country's close physical proximity to the US. As a U.S. citizen living in Canada you: Must report your worldwide income on your U.S. income tax return if you meet the minimum income filing requirements. Self-employed workers who reside in the U.S. are assigned U.S. coverage. If you live in Canada and wish to apply for U.S. benefits: Visit or write. Citizens of Canada traveling to the United States do not require a nonimmigrant visa, except for the travel purposes described below. Embassy InformationJurisdictionIceland and CanadaBusiness and TradeVisit IcelandStudy in IcelandWork and live in IcelandConsular ServicesNews. Contact us. As a citizen of the United States living in Canada, navigating tax requirements by the IRS and CRA may be difficult. Accountant Ted Kleinman explains. Native Indians born in Canada are entitled to freely enter the United States for the purpose of employment, study, retirement, investing, and/or immigration. United States, Canada, and Mexico. If you live in Canada or Mexico and commute to the U.S. to work, however, then you are not considered a resident.

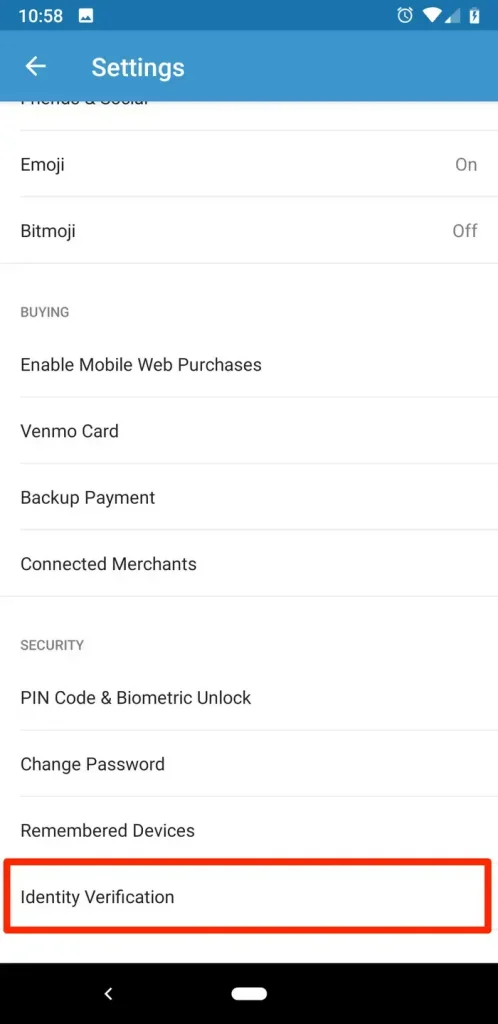

Venmo Maximum Transfer Per Day

About transfer limits You can transfer up to $10, per transfer and up to $20, within a seven-day period from Apple Cash to your bank account. You can. Up to $16, in a calendar month. To compare, Discover allows you to send up to a total of $ per day but warns that it can “change your send limit, from. By default, the Venmo transfer limit for person-to-person transfers is $ per week. When you verify your identity, the Venmo limit raises to $4, per. Maximum daily transfer amount - $10,; Maximum of 10 external transfers per month; Maximum monthly transfer amount - $40, You can send up to $10, per transaction. Your Send transaction will also be subject to a rolling day Send transaction limit (this is separate and distinct. Zelle® Send Limits · As a Bank of Hawaii customer, you can send up to $1, per calendar day. · If you are a client of The Private Bank, you can send up to. Venmo limits ☎️+1() –☎️ non-verified account transfers to $4, per day. This limit increases to $5, if the account is verified. Same Day Transfers Transfer funds to an account outside Star One in the USA. Transfer limit: $25, per hour period. After funds are transferred, deposit. Daily Venmo limit: There isn't a specific daily limit. However, there is a “per transaction” limit of $4, for verified Venmo accounts. About transfer limits You can transfer up to $10, per transfer and up to $20, within a seven-day period from Apple Cash to your bank account. You can. Up to $16, in a calendar month. To compare, Discover allows you to send up to a total of $ per day but warns that it can “change your send limit, from. By default, the Venmo transfer limit for person-to-person transfers is $ per week. When you verify your identity, the Venmo limit raises to $4, per. Maximum daily transfer amount - $10,; Maximum of 10 external transfers per month; Maximum monthly transfer amount - $40, You can send up to $10, per transaction. Your Send transaction will also be subject to a rolling day Send transaction limit (this is separate and distinct. Zelle® Send Limits · As a Bank of Hawaii customer, you can send up to $1, per calendar day. · If you are a client of The Private Bank, you can send up to. Venmo limits ☎️+1() –☎️ non-verified account transfers to $4, per day. This limit increases to $5, if the account is verified. Same Day Transfers Transfer funds to an account outside Star One in the USA. Transfer limit: $25, per hour period. After funds are transferred, deposit. Daily Venmo limit: There isn't a specific daily limit. However, there is a “per transaction” limit of $4, for verified Venmo accounts.

Transferring funds from your Venmo account to your bank account also comes with its own set of limits. The standard Venmo bank transfer limit is $19, per. There currently are no dollar amount or transfer number limits for internal transfers, provided that your accounts have sufficient available funds. Per Transfer Maximum, $1, Daily Maximum, $2, Monthly Maximum, $10, Existing Users. More Than 30 Days Since Enrollment. To/From. Per Transfer Maximum. Checking your external account transfer limits and wire transfer limits can be found by starting the transfer process. Venmo, the withdrawal limit per day currently sits at $1, If you want to withdraw more than the maximum amount, we also offer the. If you have a verified PayPal account, there's no limit on the total amount of money you can send. You can send up to 60, USD in a single transaction, but. You are limited to 30 withdrawals and a maximum transfer of $1, USD within any seven-day period. Up to 15 transactions per day. Additional limits on the. There is a spending limit of $ per day for ATM withdrawals in aggregate (checking and savings). Enter the amount of the transfer and a note explaining the. Transfers to and from external bank accounts are generally subject to separate daily and day limits. Recurring and one-time transfers count toward your. Daily purchases: $3, per day. Transaction limit: 30 per day. All of these limits reset automatically at am CST each day. There's no specific. For standard processing ( days), the daily and day limits are both $3, You're limited to 15 transactions per day and 30 per month, and payments must. You can send up to $10, per transaction. Your Send transaction will also be subject to a rolling day Send transaction limit (this is separate and distinct. You are limited to 30 withdrawals and a maximum transfer of $1, USD within any seven-day period. Up to 15 transactions per day. Additional limits on the. So to be ready for the next time you need to send or receive money,. On Discuss your financial needs on a day and at a time that work best for you. Maximum transfer amount per day: $5,; Maximum transfer amount per week: $5,; Maximum transfer amount per month: $15, Instant Transfer limit. The transfer limit for bank wires is $, per day, per client. The minimum amount for each bank wire is $ Like EFTs, if you need to wire more than. Questions? See our FAQ section below. ; Max Daily Amount, $, $2, ; Outgoing Account-to-Account ; Max Payment Amount, $, $2, ; Max Daily Amount, $1, For standard processing ( days), the daily and day limits are both $3, You're limited to 15 transactions per day and 30 per month, and payments must. Transfer Limits. Transaction Type, Daily Limits, Monthly Limits. Outbound, $2,, $5, Inbound, $6,, $15, Transfer Fees. Transaction Type.

Banks For Small Business Owners

For the ambitious business owner seeking a stable foundation, Initiate Business Checking gives you digital tools and support you can count on. It's designed for. Overview: Best banks for small business · Best for freelancers and side-hustlers: Novo · Best for accounting tools: Lili · Best for venture-funded businesses. 1. Wise Business · 2. Lili Business Checking · 3. Chase Business Complete Banking℠ · 4. NBKC Business Account · 5. Found Small Business Banking · 6. Bank of America. Earn benefits and avoid monthly fees. Open a small business checking account with Truist, and get the tools you need to get business done. Best small business banks and business accounts: Wise, Capital One, Chase, Lili, Relay, Truist, Shopify, Square, SoFi Bank, U.S. Bank, Revolut, PayPal. Banks commonly offer products like checking accounts, savings accounts, credit card accounts and merchant services accounts for small businesses. The best banks. We provide easy-to-use products, tools, and resources for small businesses to help simplify your financial life. Bank almost anywhere business takes you. Entrepreneurs are the backbone of local communities. That's why we're dedicated to helping small businesses succeed. We became the Leading Bank for Business by. Need a bank for your small business? American Express, LendingClub, Chase, U.S. Bank and Wells Fargo are among the best options for small-business banking. For the ambitious business owner seeking a stable foundation, Initiate Business Checking gives you digital tools and support you can count on. It's designed for. Overview: Best banks for small business · Best for freelancers and side-hustlers: Novo · Best for accounting tools: Lili · Best for venture-funded businesses. 1. Wise Business · 2. Lili Business Checking · 3. Chase Business Complete Banking℠ · 4. NBKC Business Account · 5. Found Small Business Banking · 6. Bank of America. Earn benefits and avoid monthly fees. Open a small business checking account with Truist, and get the tools you need to get business done. Best small business banks and business accounts: Wise, Capital One, Chase, Lili, Relay, Truist, Shopify, Square, SoFi Bank, U.S. Bank, Revolut, PayPal. Banks commonly offer products like checking accounts, savings accounts, credit card accounts and merchant services accounts for small businesses. The best banks. We provide easy-to-use products, tools, and resources for small businesses to help simplify your financial life. Bank almost anywhere business takes you. Entrepreneurs are the backbone of local communities. That's why we're dedicated to helping small businesses succeed. We became the Leading Bank for Business by. Need a bank for your small business? American Express, LendingClub, Chase, U.S. Bank and Wells Fargo are among the best options for small-business banking.

Bring ease and convenience to your small business finances – we offer a wealth of smart banking solutions designed specifically for businesses like yours. City National Bank offers tailored solutions that address the financial needs of individuals, organizations and small to mid-sized businesses with an array. Need a bank for your small business? American Express, LendingClub, Chase, U.S. Bank and Wells Fargo are among the best options for small-business banking. PNC Bank provides financial products & services to help your small business grow, including checking accounts, credit cards, loans and merchant services. Learn about small business banking from TD Bank where we have everything your business needs like checking accounts, loans, credit cards and more. Truist Bank has the tools to help your small business succeed. Open a checking account, get financing, take advantage of merchant services, and more. All your business checking account needs from cash flow management to more complex transactions—covered. Find out how Capital One business checking accounts. Our retail banking team proudly serves public and privately held companies with annual revenue of $5 million or less. We know that small businesses are the. Small Business Options at First Bank · Business loans. · Credit lines. · Commercial mortgages. · Construction loans. · Merchant services. · Checking and savings. Best Black-Owned Banks for Small Businesses · 1. Broadway Federal Bank · 2. Carver Federal Savings Bank · 3. Citizens Trust Bank · 4. First Independence Bank. Business Advantage Banking — business checking accounts designed to move your business forward with financial tools, services and dedicated support, all in one. Chase Bank: Best bank for small business for branch access and full-service banking $ if you deposit at least $2, and hold it in the account for 60 days. Chase offers a wide variety of business checking accounts for small, mid-sized and large businesses. Compare our business checking solutions and find the right. Chase Business Complete Banking℠. Chase has more than branches in the US, making it a great choice for business owners who want the convenience of bricks. Chase and Bank of America are arguably the best choice for a small business. They both are considered too big too fail, offer new account. Discover business banking products, resources and convenient digital tools to move your business forward. Find out how to put our business bank accounts. Bring ease and convenience to your small business finances – we offer a wealth of smart banking solutions designed specifically for businesses like yours. While the ASB offers small business owners this comprehensive training program, Liberty Bank is offering a $5, line of credit1 to qualifying small. Achieve financial growth with simplified small business banking solutions. Leverage our business bank accounts with mobile banking, treasury management. Whether you need a small business bank account, a business loan, a line of credit or the right banking solutions to sustain and grow your business, our team of.