itogi-2012.ru

News

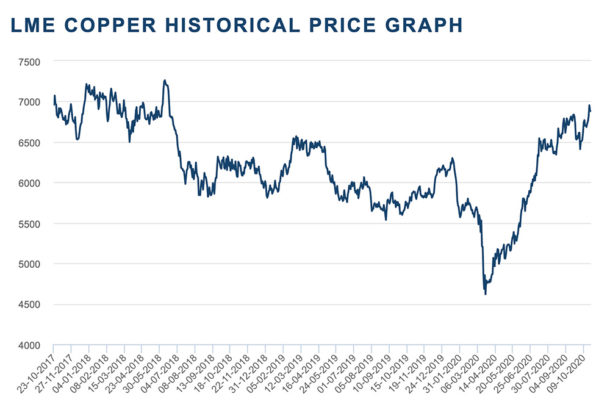

What Is Copper Worth Right Now

Copper Prices for the Last Month ; $, Aug 30, ; $, Aug 29, ; $, Aug 28, ; $, Aug 27, Copper increased USd/LB or % since the beginning of , according to trading on a contract for difference (CFD) that tracks the benchmark market. Copper Price: Get all information on the Price of Copper including News, Charts and Realtime Quotes. Please contact us for large quantities. Prices subject to change based on market conditions. ; $ per lbs. #1 Copper ; $ per lbs. #2 Copper ; call. #1. current metal prices · Non-Ferrous · For week of September · (updated ) · Copper/Brass: · Per Pound: · No. 1 Copper · No. 2 Copper Pricing ; Cars, $/Gross ton ; B&S Copper, $/lb ; #1 Copper, $/lb ; #2 Copper, $/lb. Copper. Price/lb. Bare Bright Wire (stripped/shiny), $ #1 Tubing (clean tube/ clean fine wire), $ #2 Tubing (paint/solder/burnt wire), $ Copper Price is at a current level of , down from last month and up from one year ago. This is a change of % from last month and. Bare Bright Copper: $/LB · #1 Copper: $/LB · #2 Copper: $/LB · Insulated Copper Wire: $ – $/LB* · *(based on % of Copper). Copper Prices for the Last Month ; $, Aug 30, ; $, Aug 29, ; $, Aug 28, ; $, Aug 27, Copper increased USd/LB or % since the beginning of , according to trading on a contract for difference (CFD) that tracks the benchmark market. Copper Price: Get all information on the Price of Copper including News, Charts and Realtime Quotes. Please contact us for large quantities. Prices subject to change based on market conditions. ; $ per lbs. #1 Copper ; $ per lbs. #2 Copper ; call. #1. current metal prices · Non-Ferrous · For week of September · (updated ) · Copper/Brass: · Per Pound: · No. 1 Copper · No. 2 Copper Pricing ; Cars, $/Gross ton ; B&S Copper, $/lb ; #1 Copper, $/lb ; #2 Copper, $/lb. Copper. Price/lb. Bare Bright Wire (stripped/shiny), $ #1 Tubing (clean tube/ clean fine wire), $ #2 Tubing (paint/solder/burnt wire), $ Copper Price is at a current level of , down from last month and up from one year ago. This is a change of % from last month and. Bare Bright Copper: $/LB · #1 Copper: $/LB · #2 Copper: $/LB · Insulated Copper Wire: $ – $/LB* · *(based on % of Copper).

Other current scrap prices that you may want to know include: · Electric motors can run between 10 and 20 cents per pound. · Copper transformers can run between. Current Metal Prices ; Copper Scrap. $/lb, % ; Copper Transformers. $/lb, % ; Copper Turnings. $/lb, % ; Copper Yokes. $/lb, %. Our Services · Steel. Item Type. Price. Junk Cars. Junk Cars. $/ton · Brass. Item Type. Price. Yellow Brass. Yellow Brass. $ – $/lb · Copper. Item. Current Scrap Metal Prices ; No. 1 Copper. $ / lb ; No. 2 Copper. $ / lb ; Sheet Copper. $ / lb ; #1 Insulated Copper. $ / lb ; #2 Insulated Copper. Copper price today ; Copper Price per Pound, $ ; Copper Price per Ounce, $ ; Copper Price per Ton, $8, Our Live Prices ; Aluminum Price. Extruded Aluminum, $ per lb ; Brass Price. Yellow Brass, $ per lb ; Copper Price. Bare Bright Copper (Bare Bright. We proudly publish our scrap metal prices for Pittsburgh. Below you will see our scrap copper prices, cost of lead per pound, yellow brass, aluminum cans, lead. Last Updated · Bare Bright Wire (Stripped). $ /lb · #1 Copper Clean. $ /lb · Tin Plated Copper. $ /lb · #2 Copper Dirty. $ /lb · Light Copper . How to Prepare Scrap Copper ; Bare Bright Copper Wire, $, Lb ; #1 Copper, $, Lb ; #2 Copper, $, Lb ; Hard Drawn Copper wire no brass lugs, $, Lb. Metal/Material, Current Price ; #1 Bare Bright Wire, $/lb ; #1 Copper Tubing/Flashing, $/lb ; #2 Copper Tubing/ Bus Bar, $/lb ; Insulated Copper Wire. Copper Bright Wire. $/LB ; Copper #1 Tube. $/LB ; Copper #2 Tube. $/LB ; Copper #1 Insulated Wire. $$/LB ; Copper #2 Insulated Wire. $$. Copper increased USd/LB or % since the beginning of , according to trading on a contract for difference (CFD) that tracks the benchmark market. Copper & Brass. #1 Bare Bright Wire$/lb. #1 Copper Tubing / Flashing ; Ins. Copper Wire. Insulated Copper Wire (Cat 5/6)$/lb. Romex® Wire ; Aluminum. First, it's important to know that copper scrap prices can vary quite a bit, anywhere from $ to $ per pound. The purer and thicker the copper is, the. if you were to sell it the way it is in today's market you would get average $ per pound so it would get you $ without doing a thing to it, just bring. Interactive chart of historical daily COMEX copper prices back to The price shown is in US Dollars per pound. DAILY COMEX AND LME METAL PRICES ; Copper · $ lb · 09/04Sep 04, ; Gold · $ oz · 09/04Sep 04, ; Lead · $ lb · 09/04Sep 04, DAILY COMEX AND LME METAL PRICES ; Copper · $ lb · 09/04Sep 04, ; Gold · $ oz · 09/04Sep 04, ; Lead · $ lb · 09/04Sep 04, Current Month Copper No.2 Price ; , Saturday, ; , Friday, ; , Thursday, ; , Wednesday, Copper Scrap Prices Paid by Scrap Yards in Michigan, United States ; #2 Insulated Copper Wire 40% Recovery Scrap, , , , USD/LB ; Harness Wire Scrap,

Amex Points In Dollars

You will get one point for each dollar charged for an eligible purchase on your Platinum Card from American Express. You will get 4 additional points (for a. Amex Membership Rewards points are worth 1 cent per point when you book flights and use Pay with Points through American Express Travel. $/10, MR points. American Express reward points are worth anywhere from cents to 2 cents each, depending on how you redeem them. Tip. Using points to shop or for a statement. The Amex Platinum Card is a classic offering and considered one of the best travel credit cards. With this card, you earn 5X points per dollar spent on. American Express reward points are worth anywhere from cents to 2 cents each, depending on how you redeem them. Tip. Using points to shop or for a statement. Use Reward Dollars conveniently at itogi-2012.ru checkout. Flexible. Use Reward Dollars to cover all or part of your purchases. Valuable. 1 Reward Dollar equals $. For each dollar charged on an eligible purchase in each billing period on your Amex EveryDay® Credit Card from American Express, you earn one Membership Rewards. While K Amex points will typically only give you about $2, in value when you shop for flights in the Amex travel portal, you can sometimes find Business. 6 to.8 cents per point. Now if you transfer those points to airlines or hotels thats where you can get huge value but it also varies. If you. You will get one point for each dollar charged for an eligible purchase on your Platinum Card from American Express. You will get 4 additional points (for a. Amex Membership Rewards points are worth 1 cent per point when you book flights and use Pay with Points through American Express Travel. $/10, MR points. American Express reward points are worth anywhere from cents to 2 cents each, depending on how you redeem them. Tip. Using points to shop or for a statement. The Amex Platinum Card is a classic offering and considered one of the best travel credit cards. With this card, you earn 5X points per dollar spent on. American Express reward points are worth anywhere from cents to 2 cents each, depending on how you redeem them. Tip. Using points to shop or for a statement. Use Reward Dollars conveniently at itogi-2012.ru checkout. Flexible. Use Reward Dollars to cover all or part of your purchases. Valuable. 1 Reward Dollar equals $. For each dollar charged on an eligible purchase in each billing period on your Amex EveryDay® Credit Card from American Express, you earn one Membership Rewards. While K Amex points will typically only give you about $2, in value when you shop for flights in the Amex travel portal, you can sometimes find Business. 6 to.8 cents per point. Now if you transfer those points to airlines or hotels thats where you can get huge value but it also varies. If you.

Use Pay with Points when shopping with participating brands and redeem points directly at checkout. Earn more Membership Rewards® points per dollar when you. The following assumes you have a card earning 2 points for every $1 spent: The conversion is simple – 10, points = $75 of credit, which means each point is. The value of Membership Rewards points varies according to how you choose to use them. To learn more, go to itogi-2012.ru Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50, in purchases per calendar year, then 1X points for. As you'll see in detail below, American Express redemption options generally range between cents and 1 cent per point. However, you can get much more value. Enter an estimated spending dollar amount per category below to calculate the points you could earn. Adjust yearly, monthly, or weekly spending and see how. Redeem points for cash back at a value of 1 cent each (Citi and Amex don't provide as much value for cash back). Credit cards that earn Chase Ultimate Rewards®. The following assumes you have a card earning 2 points for every $1 spent: The conversion is simple – 10, points = $75 of credit, which means each point is. Use Pay with Points when shopping with participating brands and redeem points directly at checkout. Earn more Membership Rewards® points per dollar when you. Enter your eligible American Express® Card during checkout to see your available points balance · Choose how many Membership Rewards points you would like to use. However, it's also possible to redeem those 50, points for expensive flights, using Amex's transfer partners, fetching thousands of dollars in value. How. 1X Membership Rewards® points per dollar spent on all other eligible purchases $. Yearly. Monthly. Weekly. Estimated Annual Points. Reward Points 0. To earn. Shop with Points - American Express Membership Rewards® ; Easy. Use Membership Rewards® points conveniently at itogi-2012.ru checkout ; Flexible. Use Membership. It earns Membership Rewards points per dollar spent, except for government and ATO spend which is one point per dollar. How do Membership Rewards. Turning your stash of Amex points into cash doesn't have to be complicated. With Top Dollar Payouts, you can convert your points into money in just three easy. For example, if you go to your Membership Rewards page, you can get a statement credit to pay off any of your past month's purchases with your points balance. Every time you spend using your American Express® Card, you earn redeemable points giving you access to exclusive rewards and benefits. Unlike most other. [ANA Official Website] When you use your American Express card, your Membership Rewards points can be converted to ANA Mileage Club miles. For each $1 (USD). Amex points are worth ~1 cent, so you've got ~$10, I can think of a couple of things. Take a vacation. A really nice one. Splurge. Upgrade. Five Membership Rewards® points per dollar spent on flights and prepaid hotels on the American Express Travel® portal (itogi-2012.ru). Earn points per.

How Easy Is It To Get Apple Card

It took me three months to get an Apple Card, and my credit score was/is over It's the application process that is tricky. Your credit. After a quick and simple checkout process, you will instantly receive an emailed Apple gift card. Combining iTunes Gift Cards and Apple Store Gift Cards in One. We eliminated fees and built tools to help you pay less interest, and you can apply in minutes to see if you are approved with no impact to your credit score. Why you should go for it It has no fees and low financing charges. If you miss out a bill payment, you do not have to pay that annoying late. You get 2% anywhere you use Apple Pay, and 3% at Apple Stores (and currently, Uber). I think the rewards are competitive enough with the market. There's no sign-up bonus for new cardholders. You won't get a 0% introductory APR on purchases or balance transfers. After Goldman Sachs approves your Apple Card application, they assign your initial credit limit using many of the same factors that go into the approval process. After Goldman Sachs approves your Apple Card application, they assign your initial credit limit using many of the same factors that go into the approval process. With this new product, Apple promises that it has completely reinvented the traditional credit card. All cardholder information is available on. It took me three months to get an Apple Card, and my credit score was/is over It's the application process that is tricky. Your credit. After a quick and simple checkout process, you will instantly receive an emailed Apple gift card. Combining iTunes Gift Cards and Apple Store Gift Cards in One. We eliminated fees and built tools to help you pay less interest, and you can apply in minutes to see if you are approved with no impact to your credit score. Why you should go for it It has no fees and low financing charges. If you miss out a bill payment, you do not have to pay that annoying late. You get 2% anywhere you use Apple Pay, and 3% at Apple Stores (and currently, Uber). I think the rewards are competitive enough with the market. There's no sign-up bonus for new cardholders. You won't get a 0% introductory APR on purchases or balance transfers. After Goldman Sachs approves your Apple Card application, they assign your initial credit limit using many of the same factors that go into the approval process. After Goldman Sachs approves your Apple Card application, they assign your initial credit limit using many of the same factors that go into the approval process. With this new product, Apple promises that it has completely reinvented the traditional credit card. All cardholder information is available on.

Applying for the Apple Card · Open Wallet. · Tap the + symbol in the top-right corner. · Tap Apple Card, then Continue. · Fill in the name, date of birth, email. The Apple Card is available on your iPhone through the Wallet App. Apple Pay is quick and easy to sign up for. It should be easy to repay your balance. Apple. Looking for a safe and easy way to refill your Apple ID balance quickly? Then, buy an Apple iTunes Gift Card online now! Forget about linking credit cards or. For US residents, the Apple Card is not a competitive credit card. There are enough credit cards with no annual fees offering at least 2% cash back on all. The application process for Apple Card is incredibly straightforward. Once you're invited to apply, you can do so directly in the Wallet app on iPhone. Much of. Buy US Apple Gift Cards online (worldwide email delivery) and receive your digital card in minutes. Pay with PayPal, credit card, debit card, Bitcoin. Apple says customers with a credit score of less than will not get Apple cards. This means that some people with fair credit (scores between and ). We eliminated fees and built tools to help you pay less interest, and you can apply in minutes to see if you are approved with no impact to your credit score. The minimum payment is the minimum amount you must pay towards your Apple Card balance to keep your account current. Open the Wallet app on your iPhone and tap. I recently applied for an Apple Federal Credit Card. I was very please with the process of getting approved. I appreciated how easy it was, the questions. Get Apple Card · Open the Wallet app on your iPhone. · Tap · Enter your information, then agree to the terms and conditions to submit your application. · Review the. To apply on your iPad, open the Settings app, scroll down and tap Wallet & Apple Pay, tap Add Card, then select Apple Card. If you successfully complete the program, you will receive an invitation to reapply for Apple Card that's good for 14 days The monthly credit review required. Get 2% Daily Cash back every time you pay with your iPhone or Apple Watch. Simple, secure, magical card activation. It's hard to. Apple Card makes saving and earning incredibly easy. Start by choosing to automatically deposit Daily Cash into a Savings account. Then, watch your account grow. The application process for Apple Card is incredibly straightforward. Once you're invited to apply, you can do so directly in the Wallet app on iPhone. Much of. We want to make it easier to pay down your balance, not harder. So Apple Card doesn't have any fees. Apply now. Designed to be private and secure. The application process is ridiculously easy I did as the invite email instructed and updated my iPhone to the most recent OS, then opened my. It's easy to add your partner, spouse, or other adult from your Family Sharing group as a Co‑Owner — even if they don't have their own Apple Card yet. Apple. The idea was simple, solve life's little problems, but make the technology almost invisible to the end user. In fact in my twenty seven plus.

Is A Lawyer Retainer Fee Refundable

First, your flat fee agreement is not a “true” retainer agreement. Flat-fees are “refundable”, even though you might write in your retainer that. Any attempt by an attorney to circumvent the rule that all retainers and fees are refundable by mischaracterizing a fee as an availability-only retainer would. The committee concluded that an attorney may not enter into an agreement for a client, at the outset of representation, to pay a “non-refundable retainer” that. Ethics Opinion F(a) permits advanced earned fees in the nature of a non-refundable retainer fee in certain instances; to compensate the lawyer for being. A law firm must refund unused portions of such a retainer. Under the District of Columbia Rules of Professional Conduct, a special retainer or fee advance. This retainer is a legal agreement setting our respective obligations in general. Fees, scope of services and obligations concerning your specific matter. Typically if you pay a lawyer a retainer and they don't use all of it, you are entitled to get the unused portion back. These fees are earned by the attorney upon receipt and are not refundable, regardless of whether the full amount is used for legal services. However. A lawyer may not characterize a fee as non-refundable or use other language in a fee agreement that suggests that any fee paid before services are rendered is. First, your flat fee agreement is not a “true” retainer agreement. Flat-fees are “refundable”, even though you might write in your retainer that. Any attempt by an attorney to circumvent the rule that all retainers and fees are refundable by mischaracterizing a fee as an availability-only retainer would. The committee concluded that an attorney may not enter into an agreement for a client, at the outset of representation, to pay a “non-refundable retainer” that. Ethics Opinion F(a) permits advanced earned fees in the nature of a non-refundable retainer fee in certain instances; to compensate the lawyer for being. A law firm must refund unused portions of such a retainer. Under the District of Columbia Rules of Professional Conduct, a special retainer or fee advance. This retainer is a legal agreement setting our respective obligations in general. Fees, scope of services and obligations concerning your specific matter. Typically if you pay a lawyer a retainer and they don't use all of it, you are entitled to get the unused portion back. These fees are earned by the attorney upon receipt and are not refundable, regardless of whether the full amount is used for legal services. However. A lawyer may not characterize a fee as non-refundable or use other language in a fee agreement that suggests that any fee paid before services are rendered is.

While not all situations warrant a refund of retainer fees, understanding your retainer agreement and knowing the circumstances under which a refund may be. That opinion stated that "a retainer is that non- refundable fee paid by a client to secure an attorney's availability over a given period of time and is not. A Georgia attorney may contract with a client for a non-refundable special retainer refund unearned fees, however, does not prohibit an attorney from. Be sure that you understand the difference between legal fees and costs. Ask if the remaining portion of the retainer will be refunded to you. The specific. In short, within the parameters of the Rules of Professional Conduct there is no such thing as a “nonrefundable fee,” so lawyers must not purport to collect one. An attorney may not request a retainer fee that is non-refundable. That is, should you discharge the attorney, or should the attorney withdraw from the case. Normally, most retainers are refundable. The lawyer is to take from the retainer non-disputed hourly charges and out of pocket costs (photocopies, parking. The term “non-refundable retainer” is sometimes applied to a “fixed fee” paid by a client at the outset of a matter intended to be the entire fee attributable. If the fee agreement is a nonrefundable retainer agreement, you may not be A retainer fee also can mean that the lawyer is “on call” to handle the. hether an attorney may consider an advance fee to be non-refundable depends upon two equally important factors — the circumstances of the representation and. The ethical rules limit a lawyer's freedom to agree with a client that a flat fee paid in advance will be non-refundable. If the service is not completed and. While not all situations warrant a refund of retainer fees, understanding your retainer agreement and knowing the circumstances under which a refund may be. Retainer fees can potentially be refundable or non-refundable. If the attorney requests a non-refundable retainer, it must meet specific legal requirements. For. While the attorney may be drawing against the prepayment as it is earned, the retainer will be subject to some refund to the extent it is not earned. The funds. Yes, you should receive a refund of any and all of the unearned retainer after your attorney invoices all work that was performed on your case. If the work. The retainer fee deposit is fully refundable. Any money not used for costs, expenses, and fees for legal services will be refunded to the Client at the. attorney had not earned the fee and his withdrawal from the case made the fee unreasonable. Despite the non-refundable language in the retainer, the Court. The committee has been asked to provide guidelines to attorneys on the appropriate use of non-refundable fee deposit or retainer agreements and what. The ABA recently issued an ethics opinion (Formal Opinion ) reminding attorneys and clients that advance fees cannot be nonrefundable. The opinion says that.

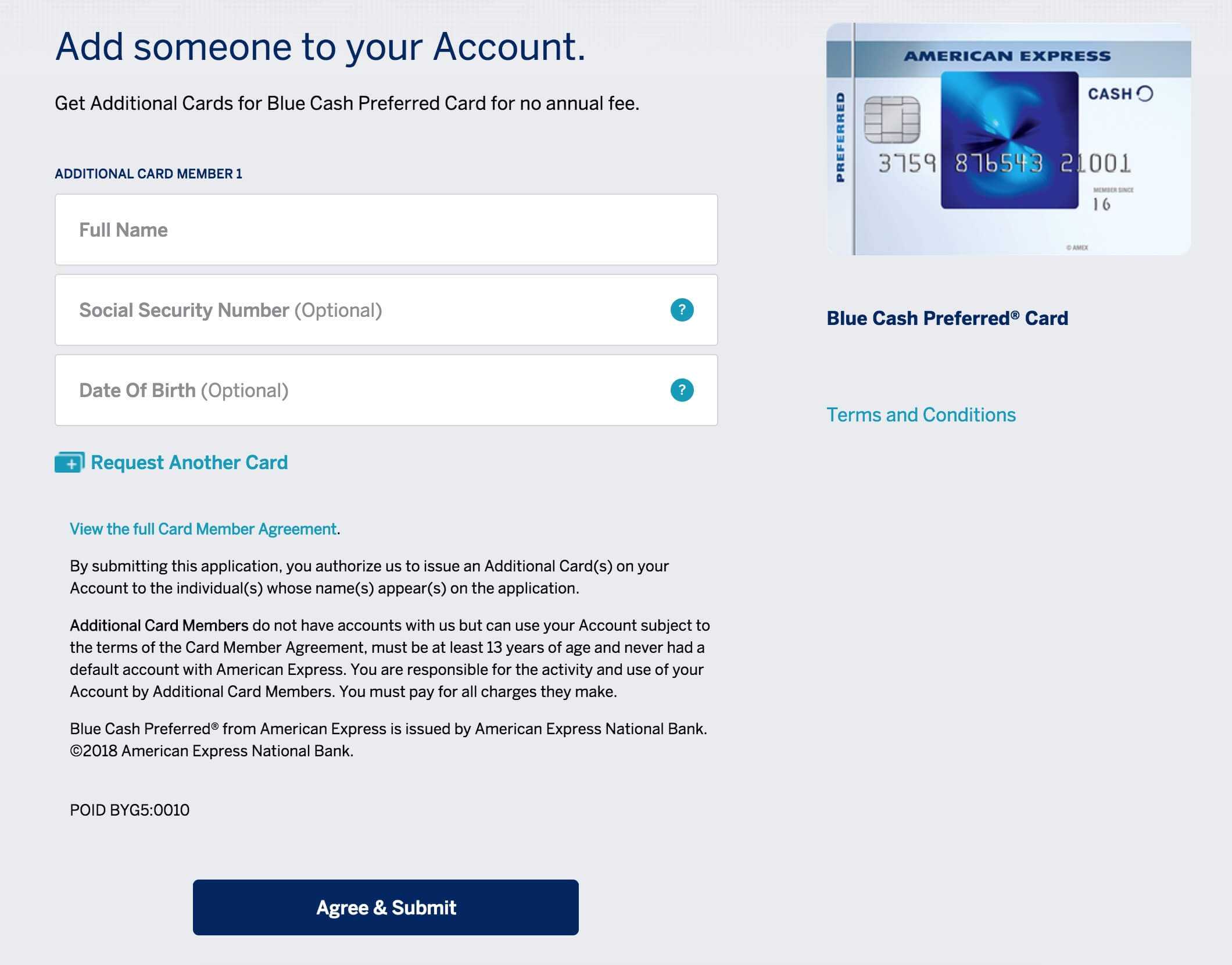

Add Authorized User Care Credit

CareCredit openly permits and encourages the account holder to use the card to finance different treatments and procedures that may not even be theirs. If you submit the application, you will need to wait 30 days to add an Authorized Buyer by calling () (TDD/TTY ). Keep in mind, you. Monday through Sunday from am - 12 midnight (EST). To add another authorized user to your account: () How To Read Your Statement. Get your. Go to Account Profile menu and select Add Authorized Users. How do I remove an Authorized User from my account? Use the Citi online process to remove an. The card holder is responsible for the payment of all charges to credit account by all authorized users. The banks don't care which user made. Authorized users don't have the same abilities as a primary cardholder, so they won't be able to increase the credit line, add more authorized users or redeem. Yes, just as a normal credit card, the owner can use it on what they choose. So, paying for your medical procedure is possible. But, with your. How do I add/become an authorized user on a credit card? The primary cardholder has to add you as an authorized user. You can either do it online, via your. Click the new CareCredit icon on desktop/home screen and follow the registration steps: Enter MID; Enter Zip code associated to that MID; Enter security token. CareCredit openly permits and encourages the account holder to use the card to finance different treatments and procedures that may not even be theirs. If you submit the application, you will need to wait 30 days to add an Authorized Buyer by calling () (TDD/TTY ). Keep in mind, you. Monday through Sunday from am - 12 midnight (EST). To add another authorized user to your account: () How To Read Your Statement. Get your. Go to Account Profile menu and select Add Authorized Users. How do I remove an Authorized User from my account? Use the Citi online process to remove an. The card holder is responsible for the payment of all charges to credit account by all authorized users. The banks don't care which user made. Authorized users don't have the same abilities as a primary cardholder, so they won't be able to increase the credit line, add more authorized users or redeem. Yes, just as a normal credit card, the owner can use it on what they choose. So, paying for your medical procedure is possible. But, with your. How do I add/become an authorized user on a credit card? The primary cardholder has to add you as an authorized user. You can either do it online, via your. Click the new CareCredit icon on desktop/home screen and follow the registration steps: Enter MID; Enter Zip code associated to that MID; Enter security token.

Many issuers allow the primary account holder to add a secondary account holder to a credit card. This person is known as an authorized user and can use the. Care Credit. Photo of happy woman with quote. Akasha now accepts CareCredit you can add authorized user to account call () ; 30 second. How to get the daily balance: We take the starting balance each day, add any new charges and fees, and subtract any payments or credits. CareCredit® Rewards™. We may change, add or delete terms of this Agreement, including interest Lending Act, (2) you or an authorized user uses the account, and (3) we. Clients can add authorized users to the account, which gives them the ability to use the account for medical expenses, by calling CareCredit at or. entered into by the actual Cardholder or an authorized user of the Qualified Card). (xii) The transaction was submitted to Bank more than thirty (30) days. Yes, the card holder can call Care Credit number to add Authorized User. They will need the new person's full name and social security number. AUTHORIZED USER/JOINT ACCOUNT. If you ask us to send a credit card to Third, we add the interest amount to the daily balance, and the sum will. Care accepts CareCredit, a third party medical expense credit card. The CareCredit and have another person added to their card as an authorized user. Access the full CareCredit healthcare credit card terms and conditions. The CareCredit credit card is issued by Synchrony Bank. The Online Usage Agreement. 7. AUTHORIZED USER/JOINT ACCOUNT. If you ask us to send a credit card to another person that you want to let use your account, you will be responsible for all. Synchrony Car Care™ credit card; Synchrony HOME™ Credit Card; SatisFi user experience by providing insights into how the site is used. To manage. A primary cardholder — the person who opened the credit card and is responsible for payments — can often add an authorized user to their account. It's a common. What is CareCredit all about? This User Guide explains the details of your CareCredit account so you can get the most out of your credit card. CareCredit is. For upgraded CareCredit credit cardholders: Once your CareCredit Rewards Mastercard is activated, your current CareCredit credit card will be closed. CareCredit is a health and pet care credit card with flexible financing options that gives How can a client add authorized users to their CareCredit credit. We add the daily interest amount in step 2 to the daily balance from step 1 Act, (2) you or an authorized user uses the account, and (3) we extend. Looking to become a CareCredit provider? Find answers to the most frequently asked questions about CareCredit's financing solution. Also, an Authorized User can be added to your account by calling our Customer Care Center at () Gateway Family Dentistry Logo. How do I add an authorized user to my card?Expand. Sign on to the Credit Card Service Center and select Add Authorized Users to Your Account under Account.

How To Get A Second Credit Card

Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that. This problem could compound if you have several cards at your disposal. Make sure you're comfortable handling a single card before you open a new one. How to. Check your credit score. You should be able to get another credit card if your credit score is high enough. If you do not currently qualify for. You can pay a credit card bill with another credit card by using either a balance transfer or cash advance, but there are pros and cons to each. Find the best credit card for your lifestyle and choose from categories like rewards, cash back and no annual fee. Get the most value from your credit card. $0 Fraud Liability: An “unauthorized purchase” is a purchase where you have not given access to your card information to another person or a merchant for one-. Let's talk about whether or not you should get another credit card and how that additional piece of plastic can help your personal finances in the long run. A second card may also give you the opportunity to take advantage of different credit card features. You may also be able to redistribute your credit limit. Having multiple credit cards could allow you more spending power and more opportunity to earn points, miles, or cash back if you use rewards cards. However, the. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that. This problem could compound if you have several cards at your disposal. Make sure you're comfortable handling a single card before you open a new one. How to. Check your credit score. You should be able to get another credit card if your credit score is high enough. If you do not currently qualify for. You can pay a credit card bill with another credit card by using either a balance transfer or cash advance, but there are pros and cons to each. Find the best credit card for your lifestyle and choose from categories like rewards, cash back and no annual fee. Get the most value from your credit card. $0 Fraud Liability: An “unauthorized purchase” is a purchase where you have not given access to your card information to another person or a merchant for one-. Let's talk about whether or not you should get another credit card and how that additional piece of plastic can help your personal finances in the long run. A second card may also give you the opportunity to take advantage of different credit card features. You may also be able to redistribute your credit limit. Having multiple credit cards could allow you more spending power and more opportunity to earn points, miles, or cash back if you use rewards cards. However, the.

Applying for a second credit card · You're not applying within 60 days of having opened your first credit card with us. · Your credit limit - you could apply for. Your length of credit history makes up 15% of your FICO credit score. While it's not a large amount, it is one factor of your credit score that you have a good. Extra rewards. Our rewards cards let you earn Loyalty Bonuses when you have a Truist checking or savings account. In such a case, you may wish to review any new terms and conditions to see if you want the new account and the new card. Generally, if the bank wants to make a. Getting a second Credit Card can be a good idea, however there are points to consider before doing it. Cited below are few of the reasons to get a second. Get special rewards like cashback, air miles or points with a reward credit card. How many credit cards can you have? Could a second credit card help you? Check your credit profile — you'll have a better understanding of the offers you're eligible for. · There are a few different types of credit cards. Each has. For example, if you opened your first card in (15 years ago) and decide to open another card today, the average length of your credit history would. Earn unlimited 2% Cash Back on all eligible purchases – no rotating Spend Categories, no caps or limits. Plus, get 2 special introductory offers. Second Bank. Personal Banking Card Services. You hold all the cards. In an credit history, we have the ideal card for you! No matter which card you. You can only have one Rewards credit card at any time, but you can apply for a different card type. · It must be at least 60 days since you applied for your. You should only open up another credit card on a day that ends in the letter “Y”. Other than that, there is no reason not to. If you get a. Check your credit. Looking at your credit reports and credit scores can help you get a sense of the cards you might qualify for. · Explore credit cards. You should apply for a second credit card only if you are sure that you can manage it well. Also, see if the new card will give you better benefits and. If your goal is to get or maintain a good credit score, two to three credit card accounts, in addition to other types of credit, are generally recommended. This. If you're looking to add another credit card to your wallet, it's worth thinking about how applying for and getting a new one could affect your credit score. The benefits of having a second Credit Card are numerous, ranging from increased security and credit score enhancement to maximised rewards and improved. Many banks approve multiple credit cards if the applicant has a good track record. Each type of credit card comes with its own set of unique benefits and hence. How to get approved for a second-chance credit card. The best way to determine your odds of approval for a second-chance credit card is to use the card issuer's. What do I do if my credit card expires?

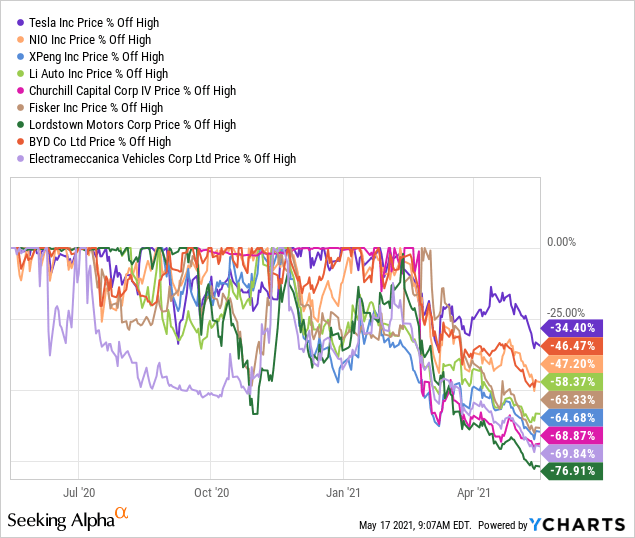

What Are Evs In Stocks

An EV stock is a company involved with the design, development or production of battery electric vehicles, hydrogen fuel cell vehicles, battery chargers. The Electric Vehicles market worldwide is projected to grow by % () resulting in a market volume of US$bn in List of all electric vehicle stocks as well as stock quotes and recent news. NIO Inc. is a holding company which engages in the design, manufacture, and sale of electric vehicles. Its products include the EP9 supercar and ES8 7-seater. Discover the top 10 electric vehicle (EV) stocks. The electric car industry is made up of companies involved in environmentally-friendly vehicles. Current market valuations for pure-play EV makers are significantly higher than for traditional OEMs relative to the number of vehicles produced. Tesla stands. Discover the top 10 electric vehicle (EV) stocks. The electric car industry is made up of companies involved in environmentally-friendly vehicles. EV-volumes is a database of sales statistics, charging infrastructure, batteries, car models, and sales forecasts for plug-in cars. As the technology improves, the EV driving range is likely to increase, weakening indirect network effects from charging stations to EV demand. In addition, in. An EV stock is a company involved with the design, development or production of battery electric vehicles, hydrogen fuel cell vehicles, battery chargers. The Electric Vehicles market worldwide is projected to grow by % () resulting in a market volume of US$bn in List of all electric vehicle stocks as well as stock quotes and recent news. NIO Inc. is a holding company which engages in the design, manufacture, and sale of electric vehicles. Its products include the EP9 supercar and ES8 7-seater. Discover the top 10 electric vehicle (EV) stocks. The electric car industry is made up of companies involved in environmentally-friendly vehicles. Current market valuations for pure-play EV makers are significantly higher than for traditional OEMs relative to the number of vehicles produced. Tesla stands. Discover the top 10 electric vehicle (EV) stocks. The electric car industry is made up of companies involved in environmentally-friendly vehicles. EV-volumes is a database of sales statistics, charging infrastructure, batteries, car models, and sales forecasts for plug-in cars. As the technology improves, the EV driving range is likely to increase, weakening indirect network effects from charging stations to EV demand. In addition, in.

Let's take a look at some important points you need to keep in mind when buying EV stocks. Expand your vision and look beyond EV automakers. Electric Vehicle ETFs ; 1, DRIV, Global X Autonomous & Electric Vehicles ETF, , % ; 2, IDRV, iShares Self-driving EV & Tech ETF, , %. Trump's new thinking appears to be that EVs themselves are fine, but car buyers should be able to choose the kind of car that works best for them without. Li Auto stock fell Wednesday as the EV-malaise continued even after the Chinese electric-vehicle leader reported better-than-expected results. EV ETFs are exchange-traded funds that invest in companies involved in the production or development of electric vehicles (EVs) or related technologies. Since December 15, , EVS are dematerialized (registered or book-entry shares). The securities in bearer form issued by the company which would not have yet. The EV charging market could — and will need to — grow nearly tenfold to satisfy the charging needs of an estimated 27 million EVs on the road by EV investment may be more of a long-term play, rather than a day trading strategy, since it can take up to five years for automakers to design, produce, and. Global EV market forecasted to reach million units with solid growth of 27% in Monday, 8 January The Global X Autonomous & Electric Vehicles ETF (DRIV) seeks to invest in companies involved in the development of autonomous vehicle technology. Blink Charging Co (BLNK) Li Auto (LI) and Nio (NIO) are some of the most trending Electric Vehicle Stocks. See how they compare to other companies such as. The share of electric cars in total sales has increased from around 4% in to 18% in EV sales are expected to continue strongly through Over 3. The full form of EV stock is electric vehicle stocks in India. It encompasses shares of electric vehicles in India, which produce, manufacture, and distribute. List of the largest EV companies by market capitalization. Only companies where over 50% of the sales comes from electric vehicles or EV technlogy sales are. These are the EV stocks to sell as they represent fundamentally weak companies struggling with cash burn and poor growth. EV Stocks News Stocks: 15 20 minute delay (Cboe BZX is real-time), ET. Volume reflects consolidated markets. Futures and Forex: 10 or 15 minute delay, CT. The Electric Vehicles market in in the United States is projected to grow by % () resulting in a market volume of US$bn in The US Electric Vehicles market is projected to grow by % CAGR () resulting in a market value of USD billion in The two key ways to invest in electric vehicles are to buy the stock of automakers that focus on making EVs, such as Tesla, or buy an exchange-traded fund that. List of Best EV Stocks to Invest in ; img Tata Motors Ltd. ₹1, BUY ; img Bharat Forge Ltd. ₹1, HOLD ; img Minda Corporation Ltd. ₹ BUY.

Amex Merchant Fee

The US Supreme Court sided with American Express (Amex) on upholding a provision in its contract that prohibits merchants from persuading shoppers to use. The discount rate is structured the same way as the OptBlue plan. AmEx does not provide information on how the flat-fee plan is calculated, however it is known. The average credit card processing fee, sometimes referred to as a "swipe fee," is %, according to the Merchant Payments Coalition. Amex: %; Discover: %; MasterCard: %; Visa: %. It is important to note that for flat rate pricing structures, most. $0 intro annual fee for the first year, then $ Intro APR. 0% for 12 months on purchases from the date of account opening. Regular APR. Many rates consist of a percentage-base charge (discount rate) without a transaction fee (flat dollar amount, i.e. $). However, virtually all credit card. Authorization for all Charges by calling American. Express. We may charge the Merchant a fee for each Charge for which it requests Authorization by telephone. Complimentary marketing to help send American Express Card Members your way · Competitive and transparent pricing with no set up costs or hidden fees · Speedy. The new fee is %. This applies to merchants in industries with a threshold limit of $1 million. The US Supreme Court sided with American Express (Amex) on upholding a provision in its contract that prohibits merchants from persuading shoppers to use. The discount rate is structured the same way as the OptBlue plan. AmEx does not provide information on how the flat-fee plan is calculated, however it is known. The average credit card processing fee, sometimes referred to as a "swipe fee," is %, according to the Merchant Payments Coalition. Amex: %; Discover: %; MasterCard: %; Visa: %. It is important to note that for flat rate pricing structures, most. $0 intro annual fee for the first year, then $ Intro APR. 0% for 12 months on purchases from the date of account opening. Regular APR. Many rates consist of a percentage-base charge (discount rate) without a transaction fee (flat dollar amount, i.e. $). However, virtually all credit card. Authorization for all Charges by calling American. Express. We may charge the Merchant a fee for each Charge for which it requests Authorization by telephone. Complimentary marketing to help send American Express Card Members your way · Competitive and transparent pricing with no set up costs or hidden fees · Speedy. The new fee is %. This applies to merchants in industries with a threshold limit of $1 million.

It use to be % as a standard credit card fee. Now it seems like %-4% is the new standard.

Most merchant accounts will allow you to accept Amex cards, but typically at a premium. For example, you may pay up to % per transaction for Amex, where Visa. Subsection , "Monthly Flat Fee" of the Merchant. Operating Manual. If we charge you a Monthly Flat Fee, we will debit your. Bank Account for such Monthly. Visa, Mastercard, Discover, Diners Club, JCB: % + $ per transaction (USD)* · American Express: % + $ per transaction (USD) · ACH/Direct Debit: 1% +. Amex Fees · Credit/Debit Assessments, % of card volume is paid directly to American Express. On a $ sale, this works out to 15 cents. · International. American Express Merchant rates are competitive and transparent, based on your industry and annual account activity. These rates are consistent across all of. Types of Credit Card and Charge Card fees ; Cash Advance Fee (enrolled Card Members only), $ or 2% of the cash advance amount (whichever is greater), $ Merchants pay a single Discount Rate (a percentage of the purchase price) for all American Express credit and charge cards. Other rates and fees may apply. Amex Interchange Fees ; Amex Retail. Amex Retail under $75, % + 10¢ ; Amex Services. Amex Services under $, % + 10¢ ; Amex Restaurant & Caterers. Amex. Important online accessible information for US merchants on how much processing fees they pay when processing Amex opt blue cards. Amex call it merchant service charge but it's between % and %. Customer spends £, merchant gets £ to £ Retailers with low. You must notify us in writing of any error or omission in respect of your Merchant Service Fee or other fees or payments for Charges or Credits within ninety . Register or sign in to make sure your American Express Online Merchant Account is properly set up. If using a third party to process Amex transactions, visit. What do I do if I have other business locations that would like to accept American Express? Simply call the Merchant Services team at (Mon - Fri. Typical costs per credit card transaction · Interchange fees: 1% to 4% per transaction · Processor (or merchant acquirer) fees: % to % per transaction . The fees can range from as low as % for international settlement programmes, up to 22% and even higher for merchants who want their cash quickly. Steeper rates have been the primary reason that merchants are hesitant to allow customers to pay with Amex; at an average fee of % per transaction—compared. Merchant may charge a Visa and Mastercard surcharge of 3%. Based on credit products only; therefore, merchant cannot surcharge Amex cards. Based. Canada - OptBlue ® Discount Rates. ; AMEX NETWORK FEESApplies to all transactions. % ; AMEX INTL CROSS BORDER FEEApplies to all international transactions. Key-entered Charges are subject to a fee. See subsection , “authorization fees.” If a Merchant accepts Card Present Transactions and also accepts payments.

Tarot Buy

Buy tarot cards from Holisticshop. A wide range of Tarot cards including Original Rider Tarot and many others. Also articles to help you learn. buy, always buy direct from the source when you can: Like our other Visions decks, this Tarot deck includes minor arcana cards that come together to tell a. Holo Tarot Deck. The Classic 78 Cards & Guidebook. Vieux Monde Express · $ · Etteilla Tarot Deck. 78 Cards & Guidebook. TAROT BOXED SET SHIPPING INFO-please read Orders are packed with care and shipped within business days from date of purchase. *Please note when new. A designer has designed a Tarot Playing Cards for sale. Shop from our selection of classic Tarot and Oracle Cards, plus some new modern favorites! Add a keepsake Tarot Bag, and don't forget to check out our. Whether you're a reader, a collector or looking for your first Tarot deck, Tarot Arts has a vast selection of Tarot cards for sale. Shop our range of cute, modern, premium, indie decks from world's talented artists. Authentic, best quality tarots that spice up tarot reading. Original Tarot Cards Deck. $ or 4 interest-free payments of $ with. Afterpay i. Buy tarot cards from Holisticshop. A wide range of Tarot cards including Original Rider Tarot and many others. Also articles to help you learn. buy, always buy direct from the source when you can: Like our other Visions decks, this Tarot deck includes minor arcana cards that come together to tell a. Holo Tarot Deck. The Classic 78 Cards & Guidebook. Vieux Monde Express · $ · Etteilla Tarot Deck. 78 Cards & Guidebook. TAROT BOXED SET SHIPPING INFO-please read Orders are packed with care and shipped within business days from date of purchase. *Please note when new. A designer has designed a Tarot Playing Cards for sale. Shop from our selection of classic Tarot and Oracle Cards, plus some new modern favorites! Add a keepsake Tarot Bag, and don't forget to check out our. Whether you're a reader, a collector or looking for your first Tarot deck, Tarot Arts has a vast selection of Tarot cards for sale. Shop our range of cute, modern, premium, indie decks from world's talented artists. Authentic, best quality tarots that spice up tarot reading. Original Tarot Cards Deck. $ or 4 interest-free payments of $ with. Afterpay i.

When a group of friends recklessly violates the sacred rule of Tarot readings – never use someone else's deck – they unknowingly unleash an unspeakable evil. Buy now with PayPalBuy with. More payment options. WINEMAKER'S NOTES. Unlock the mysteries of our Tarot Card Collection wines! Enjoy the entire Tarot Card. Shop for Tarot Cards & Books in Divination Books. Buy products such as Tarot Kit: The Future is in the Cards - With Guidebook and 78 Card Deck (Cards) at. AliExpress has a variety of Tarot cards for sale. You can buy high-quality Tarot cards with free shipping and a low price on AliExpress. Tarot Cards for Beginners, Classic Tarot Cards with Meanings on Them, Durable Tarot Cards with Guide Book for Beginners (Black). Used, New, and Out of Print Books - We Buy and Sell - Powell's. Cart |. Hello, | Login. MENU. Browse» · See All Subjects · New Arrivals · Bestsellers. the Tarot. Rendered in beautiful and luminous watercolor and inks, the Numinous purchase a discounted copy of the Numinous Tarot by selecting the. Check out our buy tarot cards selection for the very best in unique or custom, handmade pieces from our shops. buy this." Listing Image. PURPLE GOLD Tarot Deck 78 Cards, Mystical Universe, Tarot Deck with Guidebook and tarot deck bag, Tarot Deck. The Gente Tarot by Mariza Aparicio-Tovar, Mari in the Sky. Tarot deck for beginners with focus on mental health and connection to our natural environment. More than + tarot decks from all over the world. Come check out these authentic decks at a very affordable price! Decks from early 's to ! Looking for your next Tarot Deck? We've got you covered. Here you'll find everything from the classic Rider Waite Tarot Decks, Lenormand. Buy 2, Get the 3 Free: Select Kids' Pokemon, Minecraft, and Dungeons The Good Tarot: A Card Modern Tarot Deck with The Four Elements - Air. Discover the mystical world of tarot at our shop, your ultimate destination to buy tarot cards online. Explore our enchanting selection of. buy one ring get one 50% off Online Only. Use code BOGO23 at checkout. FREE SHIPPING ON ALL TAROT DECKS, ORACLE CARDS, & TAROT CARD ACCESSORIES. Tarot cards. buy mainstream decks). Platforms like Instagram can also make us feel like we have to own loads of decks in order to be proper tarot readers. But many. Buying a tarot deck from Amazon or any other online retailer is perfectly fine, and many people do so without any issues. Here we have over Tarot decks for you to experience -- you can view every card in the deck, learn about its history, and if you like what you see, buy the. This space was created for people looking to buy/sell/trade/review Tarot or Oracle decks! Please note: Reading offerings and promotions may be tarot and oracle. A page booklet aimed at the beginning student of Tarot by CYOA author and tarot practitioner Rana Tahir is included with the box. BUY ON AMAZON. Meet The.

Cigna Preferred Network Access Reviews

itogi-2012.ru is a leading dental and health savings marketplace in the US, helping more than a million people to affordably access quality healthcare. Maximize your oral health and minimize your costs with great discounts on dental services (including checkups, braces, root canals, crowns, deep cleanings. Compare Preferred Network Access By Cigna to Savon Dental Plan - we did the work for you! Dental Maintenance Organization (DMO) - review benefits and coverage information. Dental Preferred Finding an In-Network Cigna Provider. To find an in-network. Cigna HealthcareSM DPPO networks offer convenient access to quality dentists all across the country and savings on covered dental services. Certain preventive. Benefits · See reviews on in-network dentists with the Brighter Score® feature · 24/7 access to manage your dental health online with myCigna® · Discounts and. I've had Cigna for several years for my dental insurance and I've been very satisfied with their coverage. We get two free cleaning a year and they offer $ This site will allow you to search for a provider within our networks who offer discounts or negotiated rates on eligible services. With myCigna you can: Find in-network doctors, care, and cost estimates; Get access to 7 million+ verified patient reviews from other Cigna HealthcareSM members. itogi-2012.ru is a leading dental and health savings marketplace in the US, helping more than a million people to affordably access quality healthcare. Maximize your oral health and minimize your costs with great discounts on dental services (including checkups, braces, root canals, crowns, deep cleanings. Compare Preferred Network Access By Cigna to Savon Dental Plan - we did the work for you! Dental Maintenance Organization (DMO) - review benefits and coverage information. Dental Preferred Finding an In-Network Cigna Provider. To find an in-network. Cigna HealthcareSM DPPO networks offer convenient access to quality dentists all across the country and savings on covered dental services. Certain preventive. Benefits · See reviews on in-network dentists with the Brighter Score® feature · 24/7 access to manage your dental health online with myCigna® · Discounts and. I've had Cigna for several years for my dental insurance and I've been very satisfied with their coverage. We get two free cleaning a year and they offer $ This site will allow you to search for a provider within our networks who offer discounts or negotiated rates on eligible services. With myCigna you can: Find in-network doctors, care, and cost estimates; Get access to 7 million+ verified patient reviews from other Cigna HealthcareSM members.

Cigna dental plans are NOT dental insurance and the savings will vary Internet connection on both devices). List of IAB Vendors. Identify devices. Customers can submit complaints either by calling customer services at , or by sending written correspondence to Cigna Health and Life Insurance. The Cigna Preferred Network Access dental discount plan provides an average of 37% in dental work savings at as low of a price of $ per month. Read about discount dental programs (also known as dental savings plans) and how they compare to traditional dental insurance. Out-of-network costs can add up quickly. Understand the difference between in-network and out-of-network providers to help lower your health care expenses. itogi-2012.ru works with dental service providers to reduce costs on dental visits. Read about its products, see pricing and read consumer reviews. reviews and appointment availability that accept Cigna Connection Dental. DDS Inc. Delta Dental. Dental Benefit Providers. Dental Care Plus. Dental Network of. Savings network dental dentist at the time of service. Enroll in the CignaPlus Savings is a dental discount program that gives customers access. and its operating subsidiaries (“Cigna Dental”), hereby establishes a written Access Plan for its preferred provider network servicing its customers (“Network”). For Cigna in-network Behavioral Health providers, the Cigna provider directory indicates those providers who offer telemedicine services. Telemedicine claims. When you choose a plan, you will typically have access to a specific provider network. Some networks may be larger than others or may include different choices. Get affordable and quality dental care for individuals and families. › Access to over 89, in-network dental providers in our. Cigna DPPO Advantage Network. › Nearly , office locations across the nation. › No referral. Get access to the largest network In Texas, the Dental plan is known as Cigna Dental Choice, and these plans use the national Cigna DPPO Advantage network. The Cigna Dental plan offers a large network of participating providers. A For more information and to access the available information materia. Dentist by Type. Dentist by Name. Dental Practices. Find out more about the doctors and services listed in the Cigna directory and read important state and. Contact Cigna. Use the Cigna website or app to: Find a dentist (including ratings and reviews); Access click-to-chat (online. frequency limitation, dependent upon your Network General Dentist's certification of dental necessity. Surgical access to an implant body (second stage. Cigna Dental Savings® customers will not receive any discounts on dental care when visiting an out-of-network dentist or specialist. Use the form below to. With Cigna Dental Preventive, there are no deductibles or maximums and it provides access to Cigna's convenient nationwide Cigna Advantage DPPO Network.