itogi-2012.ru

Learn

Best Savings Int Rates

Best High-Yield Online Savings Accounts of September Many banks now offer high-yield savings accounts with rates above %. That's far above the. Key Takeaways. The interest rate is the amount charged on top of the principal by a lender to a borrower for the use of assets. An. Best High-Yield Savings Accounts for September Up to % · Poppy Bank – % APY · Flagstar Bank – % APY · Western Alliance Bank – % APY. Popular Direct offers great interest rates for high-yield savings accounts and CDs with a simple banking experience. Get the best investment rates and. While the average savings rate is %, the best high-yield savings accounts offer an APY ranging from % to %. As of September 3, , the highest interest savings account rate is % APY, with Boeing Employees' Credit Union on the first $ The following table. Best Savings Accounts – September ; UFB Portfolio Savings · % ; Synchrony Bank High Yield Savings · % ; Capital One - Performance Savings · %. High interest rates can certainly help you reach your savings goals sooner, and while a high-interest savings account balances security with good returns, it. Our picks at a glance ; Laurel Road High Yield Savings. %. $ ; Bask Bank Interest Savings. %. $ ; BrioDirect High-Yield Savings. %. $ Best High-Yield Online Savings Accounts of September Many banks now offer high-yield savings accounts with rates above %. That's far above the. Key Takeaways. The interest rate is the amount charged on top of the principal by a lender to a borrower for the use of assets. An. Best High-Yield Savings Accounts for September Up to % · Poppy Bank – % APY · Flagstar Bank – % APY · Western Alliance Bank – % APY. Popular Direct offers great interest rates for high-yield savings accounts and CDs with a simple banking experience. Get the best investment rates and. While the average savings rate is %, the best high-yield savings accounts offer an APY ranging from % to %. As of September 3, , the highest interest savings account rate is % APY, with Boeing Employees' Credit Union on the first $ The following table. Best Savings Accounts – September ; UFB Portfolio Savings · % ; Synchrony Bank High Yield Savings · % ; Capital One - Performance Savings · %. High interest rates can certainly help you reach your savings goals sooner, and while a high-interest savings account balances security with good returns, it. Our picks at a glance ; Laurel Road High Yield Savings. %. $ ; Bask Bank Interest Savings. %. $ ; BrioDirect High-Yield Savings. %. $

No fixed monthly fees ; % interest · with no minimum balance ; Risk-free saving. with guaranteed returns ; Free unlimited funds transfers · between your National. KOHO helps you find the best interest rates on savings accounts in Canada. Maximize your earnings and achieve your financial goals with the right account. The current interest rate of % (% Annual Percentage Yield [APY]) is accurate as of September 4, for Market Monitor accounts opened with a minimum. What are the interest rates for a savings account? Interest rates on savings accounts vary depending on the bank you choose and how rates in the broader. Evergreen Bank offers a generous % APY on its high-yield savings account, with a minimum deposit requirement of $ With no monthly fees and no minimum. Star Savings Account. Balance Tier All Balances. Interest Rate %. Annual Percentage Yield (APY) %. Available in all states. Best for daily compounding interest. Quontic Bank High Yield Savings · % ; Best for high yields. UFB Portfolio Savings · Up to % ; Best for low minimum. Earn up to % interest per annum, with monthly credit on your savings account. Maximize your savings with IDFC FIRST Bank's competitive interest rates. Our checking accounts and savings accounts provide you with the best rates available in Hawaii. Come talk to one of our representatives today! Exclusively for Exceptional Plan customers, Exceptional Super Savings earns our best savings account interest rate, along with all the flexibility of a personal. Right now, the best high-yield savings accounts offer annual percentage yields (APYs) of 5% or more. A cash ISA is the likely winner if you pay tax on savings interest (most don't). Savings Account. Earn interest at our best rate and pay no monthly fees by opening an Innovation savings account. Interest is calculated daily on the closing. High Yield CD. Best for: Earning a higher interest rate when you lock in your funds for a longer term. Explore the top online savings accounts in chosen for high-interest rates and security. Learn which accounts provide the best features without any. Featured savings accounts ; Balance $3, to $9,, % ; Balance $10, to $24,, % ; Balance $25, to $59,, % ; On portion of. Some of the top banks with the highest interest rates are Customers Bank, TAB Bank, Cloud, UFB, Bread, Bask, Upgrade, Varo and more. Regular Savings · Higher Interest Rates Available · Free Checks · Tax-Free Interest Option. Compare various options of savings bank accounts to find best high interest saving account for you among all savings bank account interest rates. Explore Citi's current rate offerings for savings accounts. Rates may vary between locations and which savings account you open. Member FDIC.

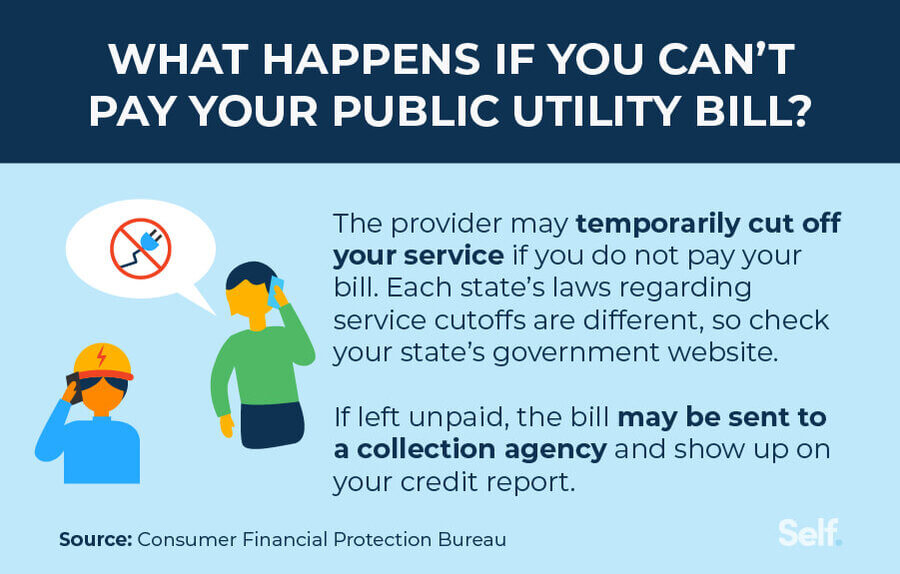

Do Utility Bills Build Credit

While most people are aware that paying their credit card bills on time is crucial for maintaining good credit, there's often confusion about whether paying. Through SimpleBills, students can not only pay their utility bills, but report bill payment history to credit bureaus and build positive credit history. Depending on the utility bills you add and your on time payment history, you could improve your score by 2 points to 15 points or more. Your utility bills . Utility bills, phone bills, cable bills, and other bills all play a role in your credit score. The impact will vary depending on the type of account, who you. Regularly paying bills like your rent, electricity and other utilities won't get reported to the three credit reporting bureaus, but not paying them will. You can improve your credit score by factoring in your on-time utility and cell phone payments. It's called Experian Boost. Short answer, yes it can affect your credit, both positively and negatively. Bills from services, like rent and utilities, usually won't show up on your credit report. Bills from loans are what will help you build credit with timely. If you pay your bills in full and on time, it can help your credit. If you don't, it can hurt your credit. Failing to pay on time can also lead to collections. While most people are aware that paying their credit card bills on time is crucial for maintaining good credit, there's often confusion about whether paying. Through SimpleBills, students can not only pay their utility bills, but report bill payment history to credit bureaus and build positive credit history. Depending on the utility bills you add and your on time payment history, you could improve your score by 2 points to 15 points or more. Your utility bills . Utility bills, phone bills, cable bills, and other bills all play a role in your credit score. The impact will vary depending on the type of account, who you. Regularly paying bills like your rent, electricity and other utilities won't get reported to the three credit reporting bureaus, but not paying them will. You can improve your credit score by factoring in your on-time utility and cell phone payments. It's called Experian Boost. Short answer, yes it can affect your credit, both positively and negatively. Bills from services, like rent and utilities, usually won't show up on your credit report. Bills from loans are what will help you build credit with timely. If you pay your bills in full and on time, it can help your credit. If you don't, it can hurt your credit. Failing to pay on time can also lead to collections.

Since early , the Experian credit bureau has offered consumers the opportunity to have utility bills reflected on Experian credit scores. To sign up for the. Failing to pay even small bills could lower your credit score. · Too many recent applications for credit could also be a negative. · If you have a business credit. Ask about getting your on-time rent or utility payments reported. Typically, rent payments, along with utility and cell phone bills, don't appear on credit. You cannot usually use utility bills to improve your credit. Most utility bills typically have no impact on your credit score because the information is not. On-time utility and telecom bill payments usually don't influence your payment history, so it typically won't help to raise your credit score, either. But. Depending on the utility bills you add and your on time payment history, you could improve your score by 2 points to 15 points or more. Your utility bills . 1 Get a credit card · 2 Get your name put on a utility bill · 3 Ensure you're registered to vote · 4 Take out a small loan · 5 Update your addresses · 6 Use your. Utility bills, such as electricity, water, or gas, typically do not show up on your credit report. However, late or missed payments can have a negative effect. Giving regular meter readings so your bills reflect accurate usage can help prevent a credit build-up. should always proactively refund any credit remaining. Ways to pay your bill · Pre-authorized debit plan · Equal Payment Plan (EPP) · Pay through your bank · Pay by credit card · Payment centre: cash, cheque or debit. None for which I am aware; utility bills are not extensions of credit. Utility companies typically do not report to credit reporting agencies. Making your utility payments on time won't generally help your credit score, but not making payments could end up hurting it. SimpleBills' credit reporting allows you to build positive credit when you pay your utilities on time – without accumulating debt. Utility bills that are in your name can help you build credit. So can store credit cards. But be careful with store credit cards as they sometimes have very. Something as simple as paying your existing bills such as water and energy on time will build up a good payment history and make it easier to obtain credit in. When you make on-time payments, you'll see your credit score stay the same or improve, and when you make late payments, in most cases, you'll see a decline in. As a utility bill isn't a credit account (you don't stack up a debt and then pay it off later like say a loan or credit card) then it isn't. Lenders and credit agencies can use utility bills as one way to examine your credit worthiness, so if you're not on the utility bills at your home address, it's. Reporting your utility accounts on your TransUnion credit report can quickly raise your VantageScore credit score*. And you can match your credit profile. But your credit score isn't just impacted by your credit card bills. You need to pay all your bills on time. That includes all your utilities, student loan debt.

Current Us Home Loan Interest Rates

Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. A fixed-rate loan of $, for 30 years at % interest and % APR will result in a monthly payment of $1, Taxes and insurance not included;. Today. The average APR on a year fixed mortgage is %. Last week. %. year fixed-rate jumbo mortgage. As of September 5, the average annual percentage rate (APR) for a year fixed mortgage is %. This is down from % the month prior and higher than. Home interest rates have varied widely since Freddie Mac began tracking them in The first time the monthly average rate for a year fixed-rate mortgage. Current mortgage rates ; Year Fixed · % · % APR ; Year Fixed · % · % APR ; Year Jumbo · % · % APR ; Year FHA · % · %. View today's current mortgage rates with our national average index, calculated daily to bring you the most accurate data when purchasing or refinancing. Compare our current interest rates ; year fixed, %, % ; FHA loan, %, % ; VA loans, %, % ; Jumbo loans, %, %. Mortgage Rates Remained Flat This Week. September 5, Mortgage rates remained flat this week as markets await the release of the highly anticipated. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. A fixed-rate loan of $, for 30 years at % interest and % APR will result in a monthly payment of $1, Taxes and insurance not included;. Today. The average APR on a year fixed mortgage is %. Last week. %. year fixed-rate jumbo mortgage. As of September 5, the average annual percentage rate (APR) for a year fixed mortgage is %. This is down from % the month prior and higher than. Home interest rates have varied widely since Freddie Mac began tracking them in The first time the monthly average rate for a year fixed-rate mortgage. Current mortgage rates ; Year Fixed · % · % APR ; Year Fixed · % · % APR ; Year Jumbo · % · % APR ; Year FHA · % · %. View today's current mortgage rates with our national average index, calculated daily to bring you the most accurate data when purchasing or refinancing. Compare our current interest rates ; year fixed, %, % ; FHA loan, %, % ; VA loans, %, % ; Jumbo loans, %, %. Mortgage Rates Remained Flat This Week. September 5, Mortgage rates remained flat this week as markets await the release of the highly anticipated.

Today's Rate on a Year Fixed Mortgage Is % and APR % The interest rate is lower than a year fixed mortgage. However, your monthly payment is. Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $1, The APR shown here is based on the interest rate, any points, and mortgage insurance for FHA loans. It does not take into account the processing fee or any. The current WSJ Prime Rate is % as of 09/03/ HELOC is a variable rate product with a Max Rate of % and a Minimum Rate of %. Margins are set. On Saturday, September 07, , the current average year fixed mortgage interest rate is %, remaining stable over the last week. For homeowners looking. More mortgage rates today · Adjustable-Rate Mortgage[2], as low as % (% APR) · Home Equity Line of Credit[3], as low as % (% APR) · Investment. Compare Current Mortgage Rates As of September 4, , the average year-fixed mortgage APR is %. Terms Explained. The current average year fixed mortgage rate fell 8 basis points from % to % on Thursday, Zillow announced. The year fixed mortgage rate on. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Today's rates for year fixed-rate mortgages are in the upper 6% to low 7% range for buyers with excellent credit. How Can I Find. The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. The current average year fixed mortgage rate fell 8 basis points from % to % on Thursday, Zillow announced. The year fixed mortgage rate on. Conforming and Government LoansExpand Opens DialogExpand · Year Fixed Rate · Interest% · APR%. Mortgage rates refer to the current interest rates that lenders offer on mortgage loans. loan or an FHA loan, can also impact your interest rate. There are. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $1, · % ; 30 Year Fixed. $1, · %. Today's competitive mortgage rates ; year fixed · % · % · ; year fixed · % · % · ; 5y/6m ARM · % · % · The current mortgage rates stand at % for a year fixed mortgage and % for a year fixed mortgage as of September 06 pm EST. Monthly principal and interest payments will be $ with a corresponding interest rate of %. Disclosures: The CommunityWorks program is only available. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Current VA Mortgage Rates ; Year Fixed VA Purchase, %, %, ($) ; Year Fixed VA Purchase, %, %, ($).

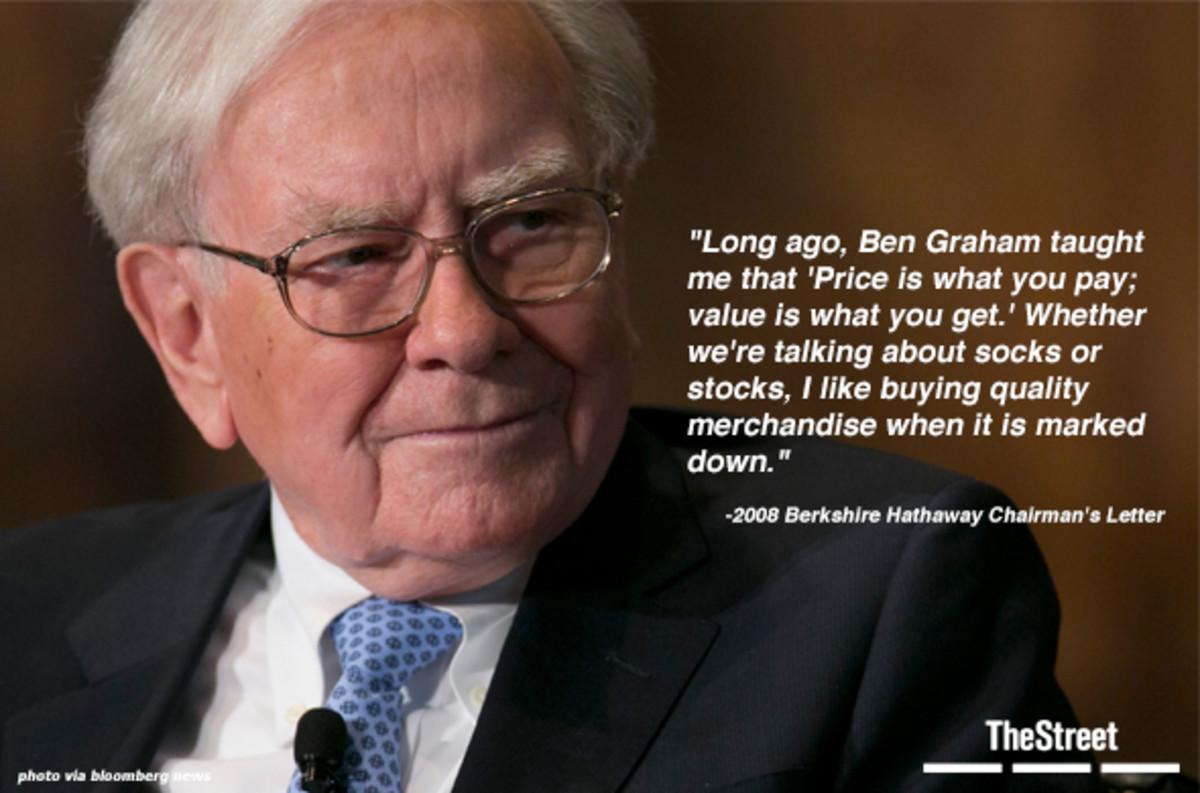

Warren Buffett Advice On Investing

Warren Buffett has said that 90 percent of the money he leaves to his wife should be invested in stocks, with just 10 percent in cash. Does that work for non-. Investment Advice by Warren Buffett · 1. Buy S&P index funds · 2. Keep the fees low · 3. Invest in companies as an owner and not as a speculator · 4. Never. Buffett's most commonly cited financial advice is as follows, “Rule №1: Never lose money. Rule №2: Never forget rule №1.” So, before investing. Warren Buffett, the richest man in the world advises us to buy stocks with "margin of safety" in mind, and ignore short term fluctuations;,(2). James C Cramer. Here are some key pieces of investment advice from Warren Buffett and how they can influence an investment strategy: 1. Invest in What You. For example, Warren likes to say that there are no called strikes in investing. Strikes occur only when you swing and miss. Warren follows his own advice. Buffett is ever the pedantic investment professor, and in this quote he reminds us that we should study, study, study. However, this advice can be often. Here are some key pieces of investment advice from Warren Buffett and how they can influence an investment strategy: 1. Invest in What You. don't lose money, and 2. never forget rule number one. This piece of advice comes into my own investment strategy in a very powerful way, which I'll talk about. Warren Buffett has said that 90 percent of the money he leaves to his wife should be invested in stocks, with just 10 percent in cash. Does that work for non-. Investment Advice by Warren Buffett · 1. Buy S&P index funds · 2. Keep the fees low · 3. Invest in companies as an owner and not as a speculator · 4. Never. Buffett's most commonly cited financial advice is as follows, “Rule №1: Never lose money. Rule №2: Never forget rule №1.” So, before investing. Warren Buffett, the richest man in the world advises us to buy stocks with "margin of safety" in mind, and ignore short term fluctuations;,(2). James C Cramer. Here are some key pieces of investment advice from Warren Buffett and how they can influence an investment strategy: 1. Invest in What You. For example, Warren likes to say that there are no called strikes in investing. Strikes occur only when you swing and miss. Warren follows his own advice. Buffett is ever the pedantic investment professor, and in this quote he reminds us that we should study, study, study. However, this advice can be often. Here are some key pieces of investment advice from Warren Buffett and how they can influence an investment strategy: 1. Invest in What You. don't lose money, and 2. never forget rule number one. This piece of advice comes into my own investment strategy in a very powerful way, which I'll talk about.

In this article, we will simplify Warren Buffett's top 7 tips for investing, distilling his advice into practical concepts that can help investors make. In conclusion · An index represents the average of a market. · A passive fund mirrors an index and therefore has much lower costs than an active fund. · Buffett. 9 Lessons In Investing By Warren Buffett · Lesson 1: Risk Comes From Not Knowing What You Are Doing · Lesson 2: System Overpowers The Smart · Lesson 3: Have An. Buffett is ever the pedantic investment professor, and in this quote he reminds us that we should study, study, study. However, this advice can be often. Investing Rules the Legendary Warren Buffett Lives By · Rule 1: Never Lose Money · Rule 2: Never Forget Rule No. · Rule 3: Pick Businesses, Not Stocks · Rule 4: A. Warren Buffett has said that 90 percent of the money he leaves to his wife should be invested in stocks, with just 10 percent in cash. Does that work for non-. Despite his success with various types of investments, his investing recommendation for most investors is simple. Known for his long-term approach, Buffett's. Warren Buffett's Advice on Investing During Inflation · 1. Invest in businesses that has enough power to raise prices to mitigate the effects of inflation · 2. Investing Rules the Legendary Warren Buffett Lives By · Rule 1: Never Lose Money · Rule 2: Never Forget Rule No. · Rule 3: Pick Businesses, Not Stocks · Rule 4: A. Buffett's most commonly cited financial advice is as follows, “Rule №1: Never lose money. Rule №2: Never forget rule №1.” So, before investing. However, as a long-term investor, your time horizon is sufficient enough that one day, down the road, you're in position to sell high. That's the Warren Buffett. Investment Advice by Warren Buffett · 1. Buy S&P index funds · 2. Keep the fees low · 3. Invest in companies as an owner and not as a speculator · 4. Never. Recognizing this difficulty, Buffett advises other investors not to consider themselves “know-it-alls”. He has said, “There is nothing wrong with a 'know. I am sure LeBron James has a diverse portfolio of investments (not just stocks). But for his stocks, Buffett recommends the passively-managed. Book overview · The beauty of the Buffett approach is its profound simplicity: follow the basics, keep your cool, and have a sense of humor and humility. · The. As usual, Buffett had plenty of advice for ordinary investors. These were the key takeaways. “For most people,” Buffett said, “the best thing to do is owning. In this blog, we delve into recent investment advice from Warren Buffett, focusing on the importance of embracing a long-term investment strategy. don't lose money, and 2. never forget rule number one. This piece of advice comes into my own investment strategy in a very powerful way, which I'll talk about. 'It's not taxed at all': Warren Buffett shares the 'best investment' you can make when battling inflation — and it doesn't have to cost you a dime · Skills are. The 90/10 investment strategy is an asset allocation model advocated by Warren Buffett. It puts 90% into stock index funds and 10% into short-term government.

What Companies Offer Dividends

9 best dividend stocks · 1. Lowe's · 2. Realty Income · 3. Chevron · 4. Target · 5. Starbucks · 6. Brookfield Infrastructure · 7. Microsoft. Dividend Aristocrats are companies that are part of the S&P and have increased their dividends in each of the past 25 years. Firms in this list have. Companies with dividend stocks regularly share a part of their profits with shareholders, typically every quarter, though some pay semiannually or even yearly. Stock. Companies can also give their investors the option of receiving additional shares as a dividend. This is called a 'scrip dividend', with these quoted on. offer or solicitation for the purchase or sale of any security, financial companies that are affiliates of Bank of America Corporation (“BofA Corp. Alternatively, a company may not pay a cash dividend, but instead offer additional shares of stock to shareholders. One option with dividends is a dividend. These 15 companies have paid out dividends for at least years—and are hoping to continue for a hundred more. Firms pay dividends to mitigate the agency costs associated with the high cash/low debt capital structures that would eventually result if they did not pay. A company that pays out a dividend attracts investors and creates demand for their stock. Dividends are also attractive for investors looking to generate. 9 best dividend stocks · 1. Lowe's · 2. Realty Income · 3. Chevron · 4. Target · 5. Starbucks · 6. Brookfield Infrastructure · 7. Microsoft. Dividend Aristocrats are companies that are part of the S&P and have increased their dividends in each of the past 25 years. Firms in this list have. Companies with dividend stocks regularly share a part of their profits with shareholders, typically every quarter, though some pay semiannually or even yearly. Stock. Companies can also give their investors the option of receiving additional shares as a dividend. This is called a 'scrip dividend', with these quoted on. offer or solicitation for the purchase or sale of any security, financial companies that are affiliates of Bank of America Corporation (“BofA Corp. Alternatively, a company may not pay a cash dividend, but instead offer additional shares of stock to shareholders. One option with dividends is a dividend. These 15 companies have paid out dividends for at least years—and are hoping to continue for a hundred more. Firms pay dividends to mitigate the agency costs associated with the high cash/low debt capital structures that would eventually result if they did not pay. A company that pays out a dividend attracts investors and creates demand for their stock. Dividends are also attractive for investors looking to generate.

The company has a great history of raising its dividend by more than 10% each year while offering a respectable yield. Pros. Dividends are the payment of a corporation's profits to its shareholders. Payment of dividends are not mandatory; rather, the board of directors may use its. Most successful companies will eventually pay a dividend. Buying stock today in a growing company means more dividends at a later date than if. World's companies with the highest dividend yields ; PPNEPCB · MYX ; JJECC · IDX ; EEWINT · MYX ; PETS · NASDAQ. There are a couple of reasons that make dividend-paying stocks particularly useful. First, the income they provide can help investors meet liquidity needs. A dividend is a small reward you get for investing in a business, usually through the purchase of stocks. · Many companies do not pay dividends, especially if. The company has a great history of raising its dividend by more than 10% each year while offering a respectable yield. Pros. US companies with the highest dividend yields ; PETS · %, USD ; RILY · %, USD ; MED · %, USD ; IEP · %, USD. Alternatively, a company may not pay a cash dividend, but instead offer additional shares of stock to shareholders. One option with dividends is a dividend. Companies often choose to pay stock dividends to shareholders when they have limited liquid cash available. What are the rules for paying dividends? Cash. Companies typically pay dividends quarterly. But some make special dividend payments at irregular intervals. Dividend stocks are typically shares of more. Chevron (CVX) International Business Machines (IBM) and Altria Group (MO) are some of the most trending Dividend Stocks. Who pays dividends Companies that offer a dividend payout tend to be larger, more established companies with proven track records of reliable growth and stock. Typically, stocks that pay dividends are larger, more established companies. And while these firms have the ability to either continue or increase payouts. companies characterized by high dividend yields. Provides a convenient way offered by Morningstar; and (4) is not warranted to be accurate. Look at dividend growth. Generally speaking, you want to find companies that not only pay steady dividends but also increase them at regular intervals—. Dividends are the payment of a corporation's profits to its shareholders. Payment of dividends are not mandatory; rather, the board of directors may use its. Dividends are payments made by corporations to their shareholders, usually in the form of cash or additional shares. These payments come from a company's. companies that don't pay dividends or cut their dividends suffered negative consequences. In FIGURE 7, dividend non-payers and dividend cutters and. Check out stocks offering high dividend yields along with the company's dividend history. You can view all stocks or filter them according to the BSE group or.

Mark Anthony Brands Stock

Mark Anthony Brands is the 4th largest beer company in the United States and a category leader in Ready to Drink with brands like White Claw Hard Seltzer. Mark and tag components so that stock inventory can be tracked and identified. Mark Anthony Brands International Waddell, AZ. $82K to $K Annually. Company profile page for Mark Anthony Group including stock price, company news, executives, board members, and contact information. Glassdoor provides our best prediction for total pay in today's job market, along with other types of pay like cash bonuses, stock bonuses, profit sharing. Examples of this plan type are Employee Stock Ownership Plan (ESOP), Profit-Sharing Plans, (a), Savings Plans and (k). A division of this type of. White Claw maker Mark Anthony Brands is partnering with soccer legend Lionel Messi to launch a new hydration beverage this summer. The Mark Anthony Group is private, but I'm certain that there are investors that underwrote the white claw acquisition. Bacchus and AB InBev. Heinz, The Kellogg Company, Dean Foods, Sara Lee Food & Beverage, Mark Anthony Brands – Mike's Hard Lemonade and Morton Salt where he held senior leadership. Mark Anthony is an entrepreneurial company pioneering in new beverage categories and building iconic brands that have transformed the alcohol beverage industry. Mark Anthony Brands is the 4th largest beer company in the United States and a category leader in Ready to Drink with brands like White Claw Hard Seltzer. Mark and tag components so that stock inventory can be tracked and identified. Mark Anthony Brands International Waddell, AZ. $82K to $K Annually. Company profile page for Mark Anthony Group including stock price, company news, executives, board members, and contact information. Glassdoor provides our best prediction for total pay in today's job market, along with other types of pay like cash bonuses, stock bonuses, profit sharing. Examples of this plan type are Employee Stock Ownership Plan (ESOP), Profit-Sharing Plans, (a), Savings Plans and (k). A division of this type of. White Claw maker Mark Anthony Brands is partnering with soccer legend Lionel Messi to launch a new hydration beverage this summer. The Mark Anthony Group is private, but I'm certain that there are investors that underwrote the white claw acquisition. Bacchus and AB InBev. Heinz, The Kellogg Company, Dean Foods, Sara Lee Food & Beverage, Mark Anthony Brands – Mike's Hard Lemonade and Morton Salt where he held senior leadership. Mark Anthony is an entrepreneurial company pioneering in new beverage categories and building iconic brands that have transformed the alcohol beverage industry.

Find company research, competitor information, contact details & financial data for Mark Anthony Brands Inc. of Chicago, IL. Find the perfect mark anthony brands image. Huge collection, amazing choice, + million high quality, affordable RF and RM images. No need to register. Search 16 Mark Anthony Brands jobs now available on itogi-2012.ru, the world's largest job site. Glazer's, Inc. v. Mark Anthony Brands, Inc. d/b/a Mike's Hard Beverage Company, No. cv - Document 13 (W.D. Tex. ) case opinion from the. Mark Anthony Brands International, an alcohol beverage business, creates and develops a portfolio of brands in ready to drink and premium craft spirits. $ $ Out of stock. Showing 1 - 12 of Show more. Brands. All brands; TY INC; Very Great Brands - Courant. Price. Min Max. Apply Close. Mark. The Champion American Stock Ale, The Black Abbey Brewing Company, LLC Mark Anthony Brands, Inc. THE CLASSIC MARGARITA by mike's peach, Mark Anthony. Mark Anthony is a private company headquartered in British Columbia with an estimated employees. In the US, the company has a notable market share in at. $ $ Out of stock. Very Great Brands - Courant Catch2 - Essentials - Camel. Very Great Brands - Courant Mark Anthony's Gifts. A short description. The MARC ANTHONY brand, founded in (France), from sister brands and competing brands. The MARC ANTHONY brand is owned by CASINO, GUICHARD. Mark Anthony Brewing proudly brews a portfolio of innovative and iconic brands, including White Claw Hard Seltzer, Mike's Hard Lemonade, Mike's Harder. What is the current stock price of MAV Beauty Brands? As of Aug the stock price of MAV Beauty Brands is $ Find Mark Anthony Brands stock images in HD and millions of other royalty-free stock photos, illustrations and vectors in the Shutterstock collection. Mark Anthony Group is $58K per year. The average additional pay is $24K per year, which could include cash bonus, stock, commission, profit sharing or tips. Mark Anthony Brewing proudly brews a portfolio of innovative and iconic brands stock. Read customer order, work order, shipping order, or requisition. Anthony von Mandl created the ready-to-drink alcoholic beverages White Claw Hard Seltzer and Mike's Hard Lemonade through his Mark Anthony Brands. Forbes. A traditional all-malt ale with a taste as strong as the country it's brewed in. With its hoppy aroma and crisp flavour, Molson Stock Ale is for those who. Find the perfect mark anthony brands image. Huge collection, amazing choice, + million high quality, affordable RF and RM images. No need to register. $ each Mikes Lemonade 12oz btl 6pk. No vote. 20 items in stock. +. –. Add to cart. mikes. $ each Mikes Lemonade ZERO Sugar. MAV Beauty Brands consists of four complementary and growing personal care brands: Marc Anthony True Professional, Renpure, Cake Beauty and The Mane Choice.

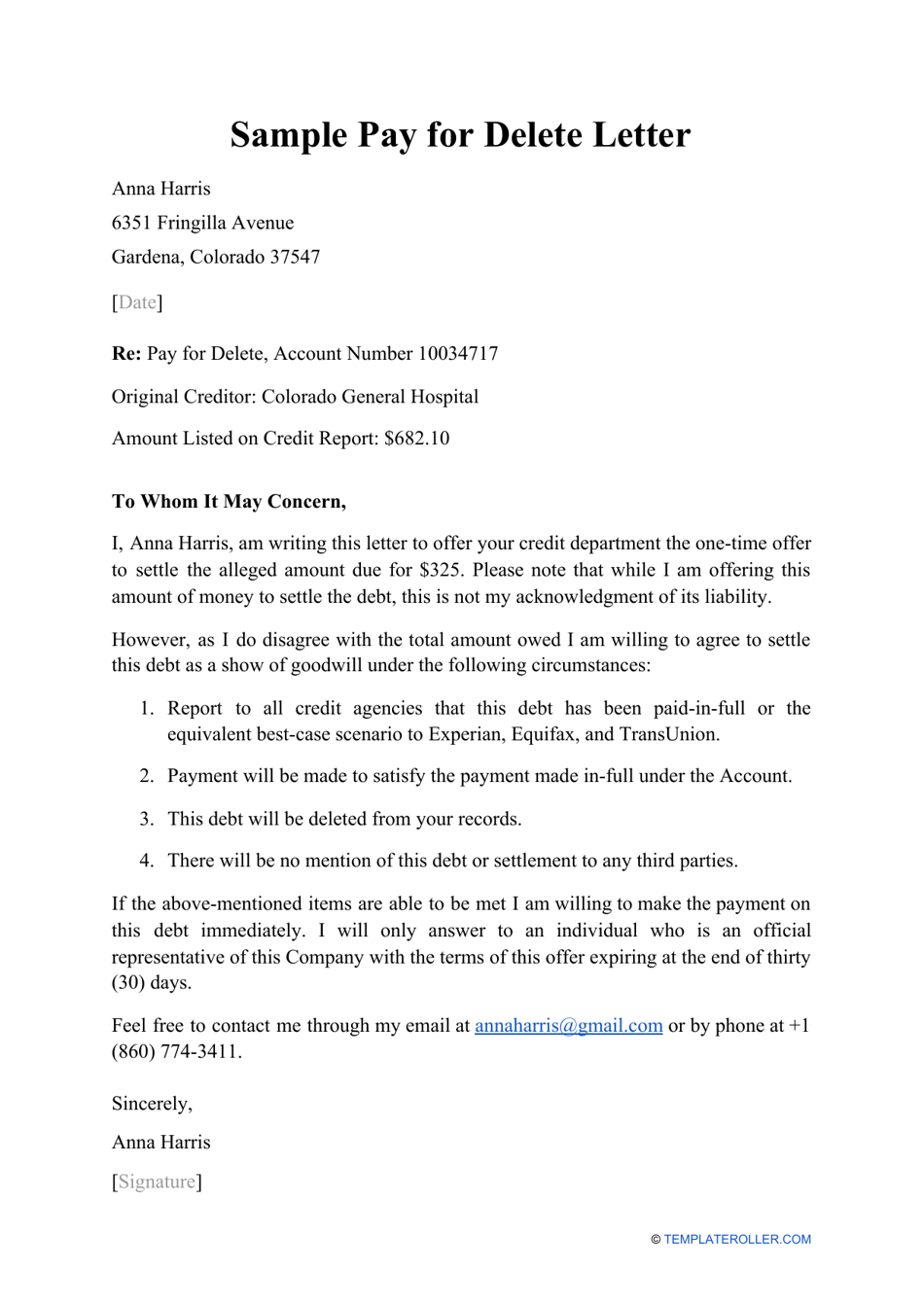

Pay To Delete Collection

This is best for collections under $ Basically, you will agree to pay the entire amount owed and they agree to remove the collection from your credit report. A pay to remove a debt letter is an offer to pay a specific amount to remove an outstanding debt listed with credit reporting agencies. In the letter, it is. Pay for delete refers to the process of getting a debt collector to remove collection account removed from your credit report. It's a point you can use during a. Often the last straw, the original creditor might sell the debt to a collection agency. In this case, the debt collector owns the debt, so any payment is made. Set up and monitor payment arrangements that will allow you to pay in full within seven years or the collection expiration date. A private collection agency. On their website, Jefferson Capital states that its policy is “to request the credit bureaus delete the tradeline approximately 30 days after the final payment. The process is discouraged. If you have an account in collections, some lenders offer that if you pay it off, they will send the credit. Some collectors harass and threaten consumers, demand larger payments than the law allows, refuse to verify disputed debts, and disclose debts to consumers'. Getting debt collectors to pay for delete is not common. Pay for delete is not necessarily an urban legend. But the sitings of examples of how often a debt. This is best for collections under $ Basically, you will agree to pay the entire amount owed and they agree to remove the collection from your credit report. A pay to remove a debt letter is an offer to pay a specific amount to remove an outstanding debt listed with credit reporting agencies. In the letter, it is. Pay for delete refers to the process of getting a debt collector to remove collection account removed from your credit report. It's a point you can use during a. Often the last straw, the original creditor might sell the debt to a collection agency. In this case, the debt collector owns the debt, so any payment is made. Set up and monitor payment arrangements that will allow you to pay in full within seven years or the collection expiration date. A private collection agency. On their website, Jefferson Capital states that its policy is “to request the credit bureaus delete the tradeline approximately 30 days after the final payment. The process is discouraged. If you have an account in collections, some lenders offer that if you pay it off, they will send the credit. Some collectors harass and threaten consumers, demand larger payments than the law allows, refuse to verify disputed debts, and disclose debts to consumers'. Getting debt collectors to pay for delete is not common. Pay for delete is not necessarily an urban legend. But the sitings of examples of how often a debt.

The balance of a collection account is not the primary factor which lowers a person's credit scores, but rather it is the fact that the. If you're negotiating with a collection agency on payment of a debt, consider making your credit reports part of the negotiations. You can ask the collector. Yet, numerous online reports argue that the platform does, and most collection agencies allow Pay for Delete to encourage consumers to repay their debts. payment is successfully posted. Within approximately 30 days of your final payment successfully posting, we will request the credit reporting agencies delete. Paying a higher settlement in exchange for pay for delete may sound like a good idea, but the reality is that the credit damage is likely to remain. At this point, the account may be assigned or sold to a debt collection agency. Pay-for-delete arrangements are legal under the Fair Credit Reporting Act. debt is disputed and ask them to delete this debt from my credit Within 21 calendar days of receiving your final payment under the settlement agreement or. The term “pay for delete” refers to the event of a debt collection account and its removal from one's credit report. The debt settlement can be demonstrated by. If your debt is sold to a debt collector, but you are ultimately unable to pay, your best course of action is to contact a nonprofit credit counseling agency or. You offer to settle a debt. If the collection company agrees to what you proposed in your letter, then they will delete the negative collection record from your. Collection debts can damage credit scores. However, they can be removed and reserved, where the negative effects can be completely revoked through a Pay for. Dear Collection Manager: This letter is in response to your [letter / call / credit report entry] on [date] related to the debt referenced above. A Pay To Delete is a negotiation tactic in which you agree to make a full or partial payment of the unpaid collections balance in return for the collection. A Pay To Delete is a negotiation tactic in which you agree to make a full or partial payment of the unpaid collections balance in return for the collection. If you're wondering how to remove collections from your credit report, you can dispute the account, send a pay for delete letter or request a goodwill. What does "Pay-to-Delete" mean? · Maybe the "agreement" was not a "legal contract" after all. · Maybe it is ILLEGAL for a Credit Bureau to remove an account. Changing debt collection. For good. Learn how January uses machine learning to recover debt collections faster and maintain world-class borrower. pay the full amount. Once you pay, you can ask the collection agency to delete the debt from your credit report or mark it “paid in full.” They don't have. Even if you paid off a collections account, it will appear on your report for up to 7 years. An exception is medical debt, which is removed from your credit. (less than $) and paid medical collection tradelines from consumer credit reports. Pay-for-delete practices are unlikely to substantially impact the number.

Discount Real Estate Agency

You will receive this cash on possession day, when you move in. *Assumes a commission of 3% of the first $, and % on the balance of the sale price. Bosley Real Estate is a Toronto brokerage that has been setting the standard for client care and exemplary results for close to a century. Realtors and brokerages that offer lower and discounted commission rates in New York for selling your home comes in a variety of forms. Leslie Lerner Properties is your #1 choice when looking for a full service Houston discount real estate agent. Home of Flat Fee Listings & Rebated. Keleher + Co. brings years of combined real estate experience in the Collingwood area to you. Buying or selling real estate? Our agents can help. sale, or lease of real property between third parties? No. An active real estate license is required to negotiate a real estate transaction between third. Right at Home Realty - the largest independent real estate brokerage in Canada. Real Estate properties to buy or sell in Toronto, Vaughan, Mississauga. real estate agent for the purchase or sale of your property, choose wisely. The California Department of Real Estate (DRE) is the state agency that licenses. What it is: Redfin is a discount real estate brokerage with in-house real estate agents who will help you sell your house for a % listing fee. Redfin is. You will receive this cash on possession day, when you move in. *Assumes a commission of 3% of the first $, and % on the balance of the sale price. Bosley Real Estate is a Toronto brokerage that has been setting the standard for client care and exemplary results for close to a century. Realtors and brokerages that offer lower and discounted commission rates in New York for selling your home comes in a variety of forms. Leslie Lerner Properties is your #1 choice when looking for a full service Houston discount real estate agent. Home of Flat Fee Listings & Rebated. Keleher + Co. brings years of combined real estate experience in the Collingwood area to you. Buying or selling real estate? Our agents can help. sale, or lease of real property between third parties? No. An active real estate license is required to negotiate a real estate transaction between third. Right at Home Realty - the largest independent real estate brokerage in Canada. Real Estate properties to buy or sell in Toronto, Vaughan, Mississauga. real estate agent for the purchase or sale of your property, choose wisely. The California Department of Real Estate (DRE) is the state agency that licenses. What it is: Redfin is a discount real estate brokerage with in-house real estate agents who will help you sell your house for a % listing fee. Redfin is.

real estate brokerage firm or salesperson to whom an agent delegates agency powers. "Transaction" means any sale, lease, rent, or exchange of real estate. A Purchase and Sale Agreement is the contract between the buyer and seller noting the terms concerning the purchase of the house (real property). Essentially. RARE Real Estate is one of Canada's fastest growing brokerages with over $3 billion in sales and thousands of pre-construction units sold. Faris Team is the top-rated real estate team in Ontario. Looking to buy or sell a home? Let us show you why Faris Team clients are clients for life. 1. Douglas Elliman · 2. Corcoran Group · 3. Compass · 4. Kaya Homes · 5. Sotheby's International Realty · 6. Halstead Real Estate · 7. Brown. The Agency represents a global portfolio of luxury real estate including, homes for sale and rent, new development, leasing, commercial and resort. RECO protects consumers in the public interest by promoting a safe and informed marketplace and administering the rules that real estate agents and brokerages. Search national real estate and rental listings. Find the latest apartments for rent and homes for sale near you. Tour homes and make offers with the help. Fort Collins Discount Real Estate Agency - Full Service Real Estate and Lending - Contact Harmony Brokers today for all your Fort Collins and Northern. % commission real estate brokerage online. Our virtual real estate company offers agents flat fee commission split programs paid per transaction with no. Seller Savings with Flat Fee Listings · Buyer Incentives with Rebates · Pro Flat Fee Realty · Traditional 6% Agent. A Real Estate Broker is any person, firm, limited liability company or sale, sells, at auction or otherwise, exchanges, buys or rents, or offers or. AssistSell is a full-service, flat-fee real estate company with offices nationwide in USA and Canada. Save money by choosing the top discount real. Pros and Cons of Being a FSBO (“For Sale By Owner”). The number one reason to sell your home without an agent's help is to avoid paying a real estate commission. Empowering REALTORS® in support of Canadian real estate journeys. If a Licensed Real Estate Broker Facilitates the Sale of his or her own Property, or the Purchase of a new Property for his or her Personal use, can That. (1) a contract by which a party, the client, for the purpose of entering into an agreement for the sale or lease of an immovable, asks the other party to. Looking to buy or sell a home? We've got you covered! Check out our property listings and find an experienced RE/MAX agent in your market. 89% of buyers purchased their home through a real estate agent or broker. For Sale By Owner (FSBO) Statistics. FSBOs accounted for 7% of home sales in.

Average Boat Insurance Cost

As previously mentioned, there are a handful of factors affecting the cost of sailboat insurance, and that makes it difficult to determine a precise average. The average boater pays a Help protect you and your boat with quality coverage from leading boat insurance companies. Get a quote for Boat Insurance. The average boat insurance cost generally falls between $ to $ a year, corresponding to approximately % of the boat's value. However, this is just a. The average annual cost for boat insurance is dollars. Since this is the average, some policies are cheaper, around dollars, and others are nearly Cost. The best way to estimate your costs is to The average boat insurance premium is about % of the boat's insured value according to Bankrate. However, on average, personal boat insurance runs $ to $1, a year with the average boat insurance policy in Texas costing around $ per year. Is Boat. However, for the most part, boaters tend to pay anywhere between three-hundred to five-hundred dollars per year on their insurance costs. In a typical boat policy, only general liability protection is included. For Call or start your online boat insurance quote today. However, coverage can vary between $ and $1, per year, but likely no more than $1, if you're only seeking basic coverage. As previously mentioned, there are a handful of factors affecting the cost of sailboat insurance, and that makes it difficult to determine a precise average. The average boater pays a Help protect you and your boat with quality coverage from leading boat insurance companies. Get a quote for Boat Insurance. The average boat insurance cost generally falls between $ to $ a year, corresponding to approximately % of the boat's value. However, this is just a. The average annual cost for boat insurance is dollars. Since this is the average, some policies are cheaper, around dollars, and others are nearly Cost. The best way to estimate your costs is to The average boat insurance premium is about % of the boat's insured value according to Bankrate. However, on average, personal boat insurance runs $ to $1, a year with the average boat insurance policy in Texas costing around $ per year. Is Boat. However, for the most part, boaters tend to pay anywhere between three-hundred to five-hundred dollars per year on their insurance costs. In a typical boat policy, only general liability protection is included. For Call or start your online boat insurance quote today. However, coverage can vary between $ and $1, per year, but likely no more than $1, if you're only seeking basic coverage.

Length – A boat's length plays a big part in the insurance cost and overall eligibility. The average-sized family boat is ft. so usually not a. $ a year for full / coverage and $35k agreed upon value for one 24' boat with a hp and $10k for my little 13' whaler with a 30hp. I. The average cost of boat insurance in California is around $ per year, based on the average of several sources. FAQs. How much does it cost to insure a boat? On average, boat insurance costs around % of the value of the boat per year. So a boat worth $10, would be. The average annual cost of boat insurance ranges from $ to $ depending on the type of boat you have and other factors. It also depends on which types of. Average national rates around $25 per month. Cons. Limited info online about No online quote tool for boat insurance. Not all coverages and discounts. The average yacht insurance policy costs around % of your yacht's value. If your yacht costs around $,, you can expect to pay around $2, for. Typical exclusions include wear and tear, marring, denting, animal damage, manufacturers' defects, design defects, ice and freezing. You may also be able to add. Factors that go into what boat insurance costs · Length. In general, boats are 26 feet and shorter; yachts are 27 feet and longer. · Value. As you'd expect, more. The average yacht insurance policy costs around % of your yacht's value. If your yacht costs around $,, you can expect to pay around $2, for. The average premium can range anywhere from $ to $1,+. Here are just some of the factors that may help determine your rates: The boat's length, type, and. In Florida, the average boat insurance cost is around $ per year. This is higher than the national average due to several factors unique to coastal states. For example, we don't require a marine survey to purchase your policy, which could cost around $ for a foot boat. Get a boat insurance quote from. Essential for all boat owners, liability insurance covers damages and injuries to others if you're at fault in an accident. This includes costs associated with. *Based on rounded national premium average of about $25 per month. Actual premiums will vary. Insurance, coverage and discounts are subject to terms and. You can have a boat in Florida with a premium of $1, and move the boat north into fresh water, and the same boat will have an insurance cost of $ The. Average national rates around $25 per month. Cons. Limited info online about No online quote tool for boat insurance. Not all coverages and discounts. The average cost of watercraft/boat insurance in South Carolina is $ per year or $44 per month. However, this cost differs due to a number of factors. For a boat valued at $50,, you can expect to pay between $ and $2, per year for insurance. The exact amount will depend on factors like the boat's type. Boat liability coverage may provide protection against lawsuits, including the payment of settlements and legal fees. Contact an agent to find out more. .

Best Credit Card With Airline Miles

Best Air Miles credit card with high earn rate. BMO AIR MILES®† World Elite®* MasterCard®*. Learn how you can earn Rapid Rewards® points with the SOUTHWEST RAPID REWARDS™ Credit Card when traveling, shopping, and dining The best part is, these are. The Chase trifecta, Amex trifecta, and Capital One duo are generally the best travel setups. But they take a bit of time and research to. There are lots of Credit card to earn airlines Miles point. #3: Southwest Airlines Rapid Rewards Priority Card at 85, points. Time to shift your focus to airline cards. If you fly Southwest Airlines, this is a no-. 14 partner offers ; Citi / AAdvantage Platinum Select World Elite Mastercard · 2x (Miles per dollar) · % - % (Variable) ; Capital One VentureOne Rewards. Here, we've compiled a list of the best credit cards for hotel points and airline miles based on this strategy. Top cards for multiple airline schemes. Amex Rewards: 10, bonus points, no fee; Amex Gold: 20, bonus points, £/yr fee from year two ; Top cards for. Marriott has by far the best hotel rewards program for Canadians, and it is so easy to get many many free hotel nights. This is especially great for those who. Best Air Miles credit card with high earn rate. BMO AIR MILES®† World Elite®* MasterCard®*. Learn how you can earn Rapid Rewards® points with the SOUTHWEST RAPID REWARDS™ Credit Card when traveling, shopping, and dining The best part is, these are. The Chase trifecta, Amex trifecta, and Capital One duo are generally the best travel setups. But they take a bit of time and research to. There are lots of Credit card to earn airlines Miles point. #3: Southwest Airlines Rapid Rewards Priority Card at 85, points. Time to shift your focus to airline cards. If you fly Southwest Airlines, this is a no-. 14 partner offers ; Citi / AAdvantage Platinum Select World Elite Mastercard · 2x (Miles per dollar) · % - % (Variable) ; Capital One VentureOne Rewards. Here, we've compiled a list of the best credit cards for hotel points and airline miles based on this strategy. Top cards for multiple airline schemes. Amex Rewards: 10, bonus points, no fee; Amex Gold: 20, bonus points, £/yr fee from year two ; Top cards for. Marriott has by far the best hotel rewards program for Canadians, and it is so easy to get many many free hotel nights. This is especially great for those who.

Winner. Delta SkyMiles Reserve American Express Card · Best for beginners. Capital One Venture Rewards Credit Card · Best for no annual fee. United Gateway℠ Card. The CIBC Aventura® Visa Infinite* Card is one of the best Visa credit cards with travel rewards. CIBC has an offer with which you can earn up to 45, If you're interested in boosting your rewards value with transfer partner travel, Chase has 14 airline and hotel transfer partners, including domestic airlines. Earn rewards you can put towards your next getaway with a Wells Fargo travel credit card. From hotel bookings to flights, you can use and earn rewards for. Airline Credit Cards ; United Explorer Card · Earn 50, bonus miles · $0 intro annual fee for the first year, then $95 ; United Quest Card · Earn 60, bonus. Learn how to select the best airline credit cards to maximize your travel rewards and enjoy exclusive benefits. Earn 75, miles once you spend $4, on purchases within the first 3 months of account opening, plus receive a one-time $ Capital One Travel credit in. Points can then be redeemed for flights, hotels and other eligible rewards items. A Travel Credit Card is an ideal choice for people who travel and are looking. Top 10+ Airline Credit Card Offers ; Citi® / AAdvantage® Platinum Select® World Elite Mastercard®. i $ 1st Yr Value Estimate. 75K Miles i Non-Affiliate. Best Credit Cards for Hotel Points & Airline Miles · Chase Sapphire Preferred Card · Chase Ink Business Preferred Credit Card · Capital One Venture X Rewards. Top Airline Credit Cards · 1) Southwest Rapid Rewards® Plus Credit Card · 2) Southwest Rapid Rewards® Priority Credit Card · 3) Southwest Rapid Rewards® Premier. BMO Ascend™ World Elite®* Mastercard®* · MBNA Rewards World Elite® Mastercard® credit card · National Bank Platinum Mastercard® · National Bank World Mastercard®. CIBC Aeroplan Visa Infinite Card about the CIBC Aeroplan Visa Infinite Card. · points per $1 directly with Air Canada® and Air Canada Vacations · points. By using an Avios-linked credit card for everyday purchases, cardholders accumulate Avios points, which can be redeemed for flights, hotel stays, or car rentals. Generic air miles cards · Tesco Bank Mastercard – each Clubcard point is worth 2 Virgin points · Amex Nectar – every Nectar points is worth Avios. Find the best RBC travel credit cards. Apply today and start earning rewards points on everyday purchases, to redeem for travel in Canada or abroad. If you're a Bank of America Preferred Rewards® member, you can earn 25%% more points on every purchase. That means instead of earning an unlimited points. Travel Rewards Credit Cards ; Citi® / AAdvantage® Platinum Select® World Elite Mastercard · 75, Bonus Miles ; Citi Strata Premier℠ Credit Card · 75,Limited. Travel Rewards – Where will you go next? Book your flights, hotels, cruises, vacation packages and car rentals using AIR MILES Reward Miles. The best airline credit cards includes airlines based in the United States and international. The big 4 US airlines of American Airlines, Delta, Southwest, and.